City PMI slides further to 45.9

Updated: 2011-10-07 06:50

By Joy Li(HK Edition)

|

|||||||

Cloudy global outlook presses HK's economy

The blow to Hong Kong's private sector economy imposed by the slowdown in Western demand has become more severe, according to HSBC's latest Purchasing Manager's Index (PMI) figures.

And although new orders from the mainland are not enough to counter it, they are expected to lend firmer support to the city's businesses in the future, the survey said.

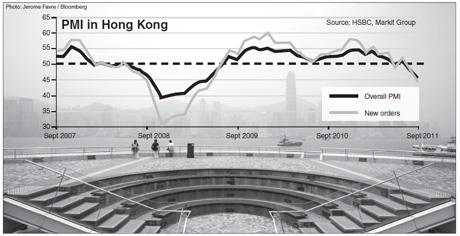

According to the latest reading of HSBC's PMI released on Thursday, Hong Kong's prevailing business conditions deteriorated further, dipping to 45.9 in September from 47.8 in August, the lowest since May 2009.

A reading above 50 indicates expansion, while that below 50 signals contraction.

The fall in the headline index was underpinned by a marked fall in total activity at Hong Kong's private sector firms during September. The index of output declined to 43.7 after August's 46.3. The index of new orders fell to 44.5 after the previous month's 48.1.

Following the moderate contraction in new business recorded in August, the rate of decline accelerated in September to the fastest since May 2009, said HSBC's report, adding that respondents flagged more challenging macro-economic conditions as the key reason behind slower new business inflows.

According to official figures, the city's exports by value showed marked signs of slowing down, with the growth rate below 10 percent in the three months to August versus a stellar 25 percent recorded in the first quarter.

Donna Kwok, Greater China economist at HSBC, noted that these figures should be kept in perspective and that "we are not yet in panic mode."

Though the dip into contraction territory is sharper than during 2008-2009, the support offered by mainland demand is also higher than previously, said Kwok.

The new China business index remained in expansionary territory, holding up at 50.5 in September relative to August's score of 52.6.

Activity in Hong Kong is cooling in response to weakening Western demand, but the mainland market is still providing a partial counterbalance. As mainland growth finds a firmer footing in the coming months, this counterbalance will increase, backed by sustained income growth and on-going infrastructure investment, according to Kwok.

Consumption and investment in the world's second-largest economy have been consistently climbing, albeit at a slower pace. According to the National Bureau of Statistics, the growth rate for fixed-asset investment on the mainland was 33 percent in 2009 and 20 percent in 2010; while that of retail sales was 17 percent and 15 percent respectively.

Economists forecast that the mainland's real GDP growth will peak after a decade of double-digit growth. Goldman Sachs cut its China growth forecast for 2012 to 8.6 percent from 9.2 percent on Tuesday, citing bleak external conditions and weak private residential investment.

The recent rise in off-balance sheet lending and debt-laden local government financing vehicles will clip the mainland's ability to weather the downturn with new stimulus compared to moves undertaken in the 2008 global financial crisis, the investment bank said.

joyli@chinadailyhk.com

China Daily

(HK Edition 10/07/2011 page2)