Listen to the market - not the pundits

Updated: 2011-09-16 07:55

(HK Edition)

|

|||||||

After all the government control measures and a slowdown in the global economy, many are now wondering where the local property market is heading. But by listening to the market instead of pundits, you may get a few hints.

The government sold another big residential site last week at a price lower than market predictions, missing surveyors' estimates for a third consecutive time.

Again, many surveyors and analysts blamed "size restrictions" for their failure to bring up a more precise estimate, noting that the government requires the winning developer to build a minimum number of flats in the project as one of the conditions of the land sale.

They cited the same reason and "multiple designated uses" for the lower-than-expected winning bids in the previous two land sales.

But it should be noted that the land sale conditions were published months ahead of the land auction or tender. And developers who participated in the last three land sales should have consulted their own surveyors before submitting their bids. In other words, developers and their surveyors have already factored in the "unfavorable" elements including "size restrictions" and "multiple designated uses".

I can think of no reason for independent surveyors to have ignored the "unfavorable" elements in their price estimates during the last three land sales as they follow the same set of professional principles.

So the only reason I could think of for a gap between the winning bid and the market consensus is that developers have recently turned cautious about the outlook for the local property market while surveyors and analysts have fallen behind the curve.

In a new sign of general caution among developers, Cheung Kong (Holdings) Ltd is selling flats in its new project in Tseung Kwan O, La Splendeur, at prices that match those of second-hand homes in the same area. As you may remember, developers used to price their new projects at a premium of 20-30 percent over second hand homes in the market. And please note: history tells us that developers are savvier than others in foreseeing the outlook for the property market.

Cheung Kong's departure from normal practice comes at a time when many would-be home buyers have also turned cautious about the prospects for property prices, resulting in sluggish home transactions in recent months.

Home sales fell 63 percent in August from the same period a year ago, the eighth consecutive monthly drop, the latest data from the Land Registry shows.

As a result of their cautiousness towards the outlook for home prices, many prospective buyers have shifted to the rental market, helping push up rents in the city.

The average rent for private homes rose a further 1.3 percent in August to HK$20.94 per square foot, exceeding the historical high of HK$20.85 per square foot recorded in September 1997 when the property market peaked, according to data compiled by Midland Realty.

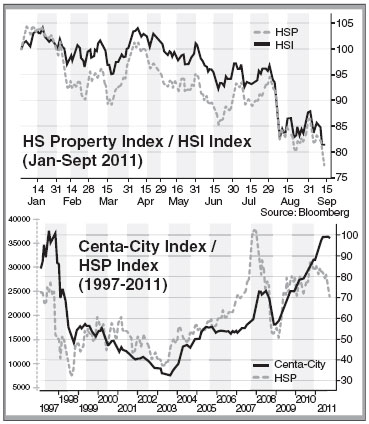

Stock investors have been the most bearish about the outlook for the property market this year, as indicated by the persistent underperformance of the share prices of developers compared with the broader market since January 1.

Received wisdom in the city tells us that share prices usually lead home prices by a few months. Now, however, we have seen a 17 percent retreat in the benchmark Hang Seng Index year-to-date.

So, putting it altogether, what are all these signs telling us?

The author is a staff writer of China Daily. The opinions here are his own.

(HK Edition 09/16/2011 page2)