Towngas profit up on mainland growth

Updated: 2011-08-24 08:49

By Joy LI(HK Edition)

|

|||||||

|

The Hong Kong & China Gas logo in the city. Chairman Lee Shau-kee predicted steady growth in its local business, which is expected to have 25,000 new customers by the end of this year. Paul Hilton / Bloomberg |

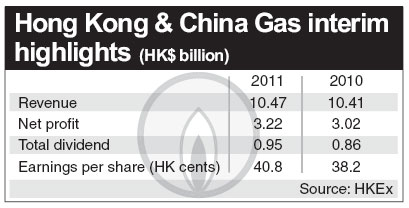

Firm's net income advances 6.7% to HK$3.22 billion

Hong Kong & China Gas Co, the blue-chip piped-fuel supplier, said its first-half net profit rose 6.7 percent on growth in its mainland businesses.

For the first six months ended June 30, net income increased to HK$3.22 billion ($410 million), up 6.7 percent from the previous year, the company, known as Towngas, said in its interim result statement released on Tuesday.

Turnover climbed 0.6 percent to HK$10.47 billion compared with a year ago. The company declared an interim dividend of 12 HK cents, the same as last year.

Earnings before interest, tax, depreciation and amortization (EBITDA) in its Hong Kong gas business for the first-half was HK$2.42 billion, represented 64 percent of its overall profit and was flat compared with a year ago.

The total volume of gas sold in Hong Kong increased 2.9 percent in the first six months, boosted by restaurant and hotel sectors that accommodated more inbound tourists and lower average temperatures compared with the same period last year, said the company.

The fuel supplier, controlled by billionaire Lee Shau-kee, was founded in 1862, the city's first public utility. To ensure future growth outside the city's limited market, the company has invested extensively in the mainland, becoming the largest city-gas enterprise there.

Towngas currently has 127 projects spread across 21 regions, including natural gas, water supply and wastewater treatment, and emerging environmentally-friendly energy.

In the first half of 2011, EBITDA from the Chinese mainland reached HK$1.31 billion, up 27 percent from a year ago. Gas sold on the mainland rose 21 percent in the first six months.

The shortfall in natural gas supply has plagued the company in the past few years. However, with the gradual completion of large-scale natural gas projects, including transmission pipelines from Sichuan province to eastern and southern China and phase two of the West-to-East pipeline, Towngas expects better access to sufficient gas resources in the future.

The fuel supplier said it will keep on looking for investment projects on the mainland.

In terms of business outlook, Chairman Lee Shau-kee predicted steady growth in its Hong Kong business, which will serve 25,000 new customers during 2011. The number of customers in Hong Kong as of June 30 was 1,736,923.

Lee pins more hope on the mainland, where urbanization and energy conservation is advocated by the government.

"The combined results of the group's emerging environmentally-friendly energy businesses and mainland utility businesses will overtake that of its Hong Kong gas business in 2012, and will have faster growth momentum than its Hong Kong gas business thereafter given their good prospects," said Lee in the statement.

In an July industry research report, analysts at Nomura International (Hong Kong) Limited believe that the gas distribution sector in China is "booming" on strong demand, supportive policies, better gas resources supply and sustainable gas connection fees.

China has pledged to reduce carbon emission intensity by 40-50 percent by 2020.

In the 12th Five-Year Plan for the economy, natural gas as a proportion of the primary energy mix is projected to be raised from 3.9 percent in 2009 to 8.3 percent in 2015. The world average is 23.8 percent, according to Nomura.

China Daily

(HK Edition 08/24/2011 page2)