HSI plunges more than 3% on growth concerns

Updated: 2011-08-20 06:53

(HK Edition)

|

|||||||

|

A woman uses her mobile phone to take a picture of the Hang Seng Index in Hong Kong on Friday. The index dived as investors scrambled to liquidate more of their long positions in the face of a gloomy global economy. Laurent Fievet / AFP |

Govt official calls for calm as global economy fears return

Secretary for Financial Services and the Treasury K.C. Chan urged investors to "stay calm" as the Hong Kong stock market witnessed another upheaval on Friday, with the benchmark index plunging more than 3 percent.

"I ask investors to stay calm, look at the numbers, and look at exactly how it will affect their own economy, and not to be spooked by the market that easily," Chan said in an interview with Bloomberg Television.

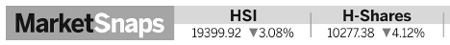

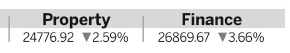

The Hang Seng Index slumped 3.08 percent to close at 19399.92 as investors scrambled to liquidate more of their long positions on concerns that global growth is faltering and Europe's debt crisis is out of control.

The benchmark fell 1.1 percent for the week, extending its weekly decline to four, its longest losing streak since June. All but three stocks in the 46-member gauge fell.

The Hang Seng China Enterprises Index of Chinese companies listed in Hong Kong plunged 4.12 percent to 10277.38, its lowest closing level since May 2009.

"Investors are fearful, there's no doubt about that," said Khiem Do, the Hong Kong-based head of multi-asset strategy at Baring Asset Management, which oversees about $10 billion.

"Equity investors always focus on growth and profit margins, and the US economy, showing signs of slowing down, has brought down our markets significantly. Sentiment is bearish, and in times like these, investors should think about long-term investments."

Total turnover of the market increased 13.5 percent to HK$81.9 billion on Friday trading compared with that of Thursday.

Along with the sell-off, the volume of short-selling also increased. Short-selling remained high at more than 11 percent of total turnover, suggesting that some market players were betting on further declines even after a 13.5 percent fall on the benchmark in August. For the three months ended on Thursday, short-selling accounted for 8.5 percent of average daily turnover.

Companies that generate a big chunk of their revenue from overseas markets were hardest hit as investors fretted about the weak US data and the deteriorating European debt crisis.

A report showed the Federal Reserve Bank of Philadelphia's general economic index plunged to minus 30.7 this month, the lowest reading since March 2009, from 3.2 in July. Readings less than zero signal contraction in the area covering eastern Pennsylvania, southern New Jersey and Delaware.

The US economy may expand less than previously forecast in 2011 and 2012 because of potential "political paralysis" and fiscal tightening, Citigroup Inc said.

US government data also showed more Americans than forecast filed applications for unemployment benefits last week, while the cost of living climbed in July by the most in four months.

Separately, the National Association of Realtors said sales of US previously owned homes dropped in July, reflecting an increase in contract cancellations due to strict lending rules and low appraisals.

Li & Fung dropped 4.7 percent to HK$12.72, while Techtronic Industries Co, maker of Ryobi power tools and Hoover vacuum cleaners, sank 5.5 percent to HK$7.09. HSBC Holdings Plc, the UK-based lender that made a fifth of its revenue in North America last year, slid 4.2 percent to HK$65.20.

Esprit fell 3.8 percent to HK$20.50. Cosco Pacific Ltd, which operates container facilities at Greece's Piraeus port, retreated 5.5 percent to HK$9.90. Standard Chartered Plc, the UK's second-biggest bank by market capitalization, declined 4.2 percent to HK$170.

China Daily - Bloomberg

(HK Edition 08/20/2011 page2)