Li & Fung earnings dip 15%

Updated: 2011-08-12 09:17

By Oswald Chen(HK Edition)

|

|||||||

|

William Fung, deputy chairman of Li & Fung Ltd, listens during a news conference on Thursday. The company's first-half profit fell 15 percent as higher costs squeezed its margins. Jerome Favre / Bloomberg |

Global consumer goods exporter and logistics group Li & Fung Limited posted a 15 percent decline in net profit due to soaring operating costs unleashed by the market share expansion through organic growth and acquisitions.

They added that macroeconomic uncertainty due to the US and European debt crises also dampened earnings.

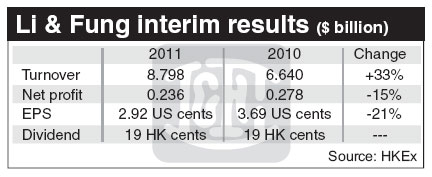

The exporter made an interim net profit of $236 million for the six months ended June 30, down 15 percent from $278 million a year ago. Earnings per share plummeted by 21 percent to 2.92 US cents per share. The company recommended an interim dividend of HK$0.19 per share, unchanged from a year ago.

Though the group's revenues jumped 33 percent to nearly $8.8 billion, operating costs in the first six months also swelled by 74 percent to $973 million from a year ago, thus leading to a 16 percent decline in the core operating profit to $282 million from $338 million a year ago.

Although the company's business is being affected by the faltering US economy and the European debt crises, its management is confident that the business targets of the new three-year business plan through 2013 can still be achieved.

"We have diversified our revenue streams into China and the Asia region. These two places currently account for 12 percent of our total revenues. In addition to revenue diversification, we relied on capturing market share to boost our revenue growth," said William Fung, the company's executive deputy chairman.

The global goods exporter announced in March that it hopes to double its core operating profit to $1.5 billion by 2013, 50 percent higher than in the previous three-year plan to 2010, which missed its $1 billion core operating profit by some $275 million.

Looking ahead, the company will rely on acquisition deals and stringent cost controls to propel future business growth.

The company will relocate more jobs to the mainland, Bangladesh, Vietnam and India. It may cut staff in the US and Europe to contain the growth of operating costs.

China Daily

(HK Edition 08/12/2011 page2)