HKMA echoes support for peg

Updated: 2011-08-09 07:16

By Joy Li(HK Edition)

|

|||||||

Chan emphasizes stability despite turbulent markets

Hong Kong will stick with its policy of pegging its currency to the US dollar despite the move by ratings agency Standard & Poor's on August 5 to strip the United States of its AAA credit rating, said Norman Chan, chief executive of the Hong Kong Monetary Authority (HKMA).

Chan told reporters on Monday that US bonds and the dollar are still the "safest assets" and HKMA will not change its investment strategy.

HKMA held foreign currency assets worth $288 billion as of June 30.

"I don't think the ratings downgrade should impact the US government bond interest rate. International investors will continue to view US government debt as the safest and the most liquid tool for investment and risk-averse purposes," said Chan. He added that "growth momentum in the US will be slow in the second half, but the risk of a double dip recession is not very high."

Chan's comment came after Standard & Poor's cut America's credit rating by one level to AA+ on August 5, extending turmoil on various markets in Asia.

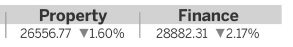

The Hang Seng Index lost 2.17 percent to 20,490 on Monday's trading, after recording the biggest decline in 18 months on August 5. The MSCI Asia Pacific Index slid another 2.4 percent in Tokyo on Monday, adding to last week's 7.8 percent drop.

On the forex front, Asian currencies advanced on Monday, led by Singapore dollar and the yuan. The Singapore dollar advanced the most in a week, up 0.4 percent to S$1.2143 versus the US dollar, according to data compiled by Bloomberg. The yuan climbed to a 17-year high, up 0.07 percent to 6.436 per US dollar.

"The downgrade was just another milestone in the progressive deterioration of the US long-term outlook and of the US dollar's unique status," according to the HSBC Asian FX research report released on Monday.

Chan admitted on Monday that there has been recent talk that the city's peg to the greenback, which started in 1983, should be changed. Two main options have been bandied about: either linking the Hong Kong dollar to a basket of currencies or adopting a floating exchange rate regime.

Chan noted that neighboring markets, despite being more autonomous in setting their exchange rate, are also grappling with headaches such as inflationary pressure and a heated housing market similar to Hong Kong.

"Since 1983, Hong Kong's linked exchange rate has been very effective. It's the cornerstone of the city's monetary and financial stability. We have no intention to change it," Chan said.

China Daily

(HK Edition 08/09/2011 page2)