Raising the reserves ... and doubts

Updated: 2011-08-03 07:11

By Oswald Chen(HK Edition)

|

|||||||

With Basel III just around the corner, investors are wary about long-term investment prospects in the city's banks. Oswald Chen reports.

Local banks will start to gradually implement the "Basel III Bank Capital Standards" starting from 2013, when they will be obliged to raise their capital adequacy ratios to meet future regulatory requirements. But these new capital requirements are also raising uncertainties about the long term investment prospects of Hong Kong-listed bank stocks.

"Local listed bank stocks are already cutting their dividend payout ratios as a proactive response to the increase in capital adequacy ratios required by the Basel Committee, so locally-listed banks may not be able to sustain their high and stable dividend payouts as they did in the past," BMI Fund Management President Patrick Shum told China Daily.

And if some local banks have to cut their dividend payout ratios, this may cause sentiment by local investors to weaken as they generally favor locally-listed banks stocks due to high and stable dividend payouts.

Some other analysts went even further and pointed out that some individual banks are more prone to reducing their dividend their payout ratios than others.

"As local banks have to set aside more reserves to maintain a high capital adequacy ratio, the dividend payout ratio of some local banks may be affected," Kingston Securities Research Manager Dickie Wong told China Daily.

"The dividend payout ratio for Bank of East Asia and Chong Hing Bank is likely to be reduced," Wong noted. "For Bank of East Asia, the bank is aggressively expanding its business footprint on the mainland and that may exhaust its cash reserves. Together with the gradual introduction of the Basel III requirement, this bank may face a cash shortfall that could prompt it to cut its dividend payout ratio."

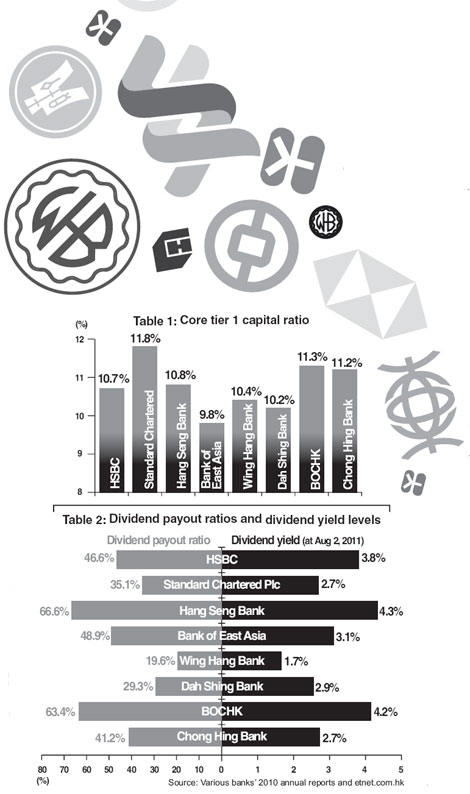

The dividend payout ratio of Bank of China (Hong Kong), Hang Seng Bank, Dah Sing Bank and Wing Hang Bank should not be affected as these banks are still relatively well capitalized, Wong said. (Table 2)

Table 1 lists the capital adequacy ratios of major local-listed banks based on the data of their 2010 annual reports. The table shows that while Standard Chartered Plc has the highest capital ratio, Bank of East Asia's ratios are the lowest.

The Basel Committee on Banking Supervision (BCBS) in September 2010 announced the "Basel III Bank Capital Standards" to strengthen existing bank capital requirements in order to help global banks better absorb potential losses after global banks were battered by the financial tsunami triggered by the collapse of the US investment bank Lehman Brothers in 2008.

Under the Basel III requirement, Hong Kong banks' core tier 1 capital ratio is set at 4.5 percent, tier 1 capital ratio at 6 percent and the total capital ratio at 8 percent. In addition, banks will be required to hold an additional "capital conservation buffer" of 2.5 percent by 2019. This will make the total capital plus the capital buffer ratios to be set at 10.5 percent by 2019.

To counteract excessive credit growth in times of economic boom, a "countercyclical capital buffer" of 0 percent to 2.5 percent, in addition to the "capital conservation buffer" would be imposed to contain the build-up of system-wide risk unleashed by excessive credit growth. The Basel committee did not specify when or how this "countercyclical capital buffer" would be phased in.

The "regulatory reserve" of 1 to 1.5 percent currently proposed by the Hong Kong Monetary Authority (HKMA) resembles the "countercyclical capital buffer" concept proposed by the Basel committee whereas an additional capital cushion may be needed to counteract the systemic risks to the local banking industry during an economic recession. The regulatory reserve is a non-distributable reserve that is earmarked against the retained earnings of local banks. As local banks have to set aside some portion of the retained earnings into the regulatory reserves, it may curb their capability to maintain their high and stable dividend payouts.

Other analysts cautioned that as the actual situation in the global financial market can change very rapidly, the actual effects of the Basel III requirement on local banks' profitability and dividend payouts has still not been fully discerned.

"If HKMA proposes harsher capital requirements toward local banks than is required by Basel III, local banks' future profitability and dividend payouts will be affected," Timothy Li, a banking analyst at Core Pacific-Yamaichi told China Daily.

Meanwhile, Hong Kong's rival Singapore recently levied stricter capital requirements than the Basel Committee has proposed in order to consolidate the city-state's position as a financial hub. The Monetary Authority of Singapore (MAS) in June required Singaporean banks' core tier 1 capital ratio to reach 6.5 percent, tier 1 capital ratio to reach 8 percent and the total capital ratio to 10 percent, which are all 2 percentage points higher than the Basel requirement.

Amid the competition from Singapore, the HKMA may announce stricter capital requirement than the Basel III requirement in order to maintain a level playing field with Singapore. If this scenario really happens, local banks will have to set aside more capital that curbs their future profitability and dividend payouts.

Apart from the regulatory hurdle posed by the Basel III requirement, local banks still have to confront the other difficult facets of the daily business operating environment in the days ahead.

"The slow down in corporate lending will bite the benefits brought by improvement in net interest margins, and with the moderate increase in fee incomes due to market volatility, coupled with rising operating costs, the investment prospects of locally-listed banks can only be graded as neutral," Kingston's Wong said.

BMI's Shum echoed this. "Due to the sluggish growth in commission and other fee incomes, moderate improvement in net interest margins and the banks' lending business in the city having already been saturated given their high loan-to-deposits ratios, local banks will have to confront the business environment that will likely slow down their profit growth in the future."

A recent Goldman Sachs investment reports downgraded the target price range of various local banks, citing a tightening of market liquidity and net interest margins. It said rises in operating expenses, and a fall in interest income due to volatile macroeconomic performance will crimp the profit performance of local medium-sized banks.

(HK Edition 08/03/2011 page2)