Cross-border home sales ease as curbs begin to bite

Updated: 2011-07-27 07:28

By Li Tao(HK Edition)

|

|||||||

The number of Hong Kong citizens buying property on the mainland fell slightly in the first half of 2011 due to central government measures to curb the sector, statistics released on Tuesday show.

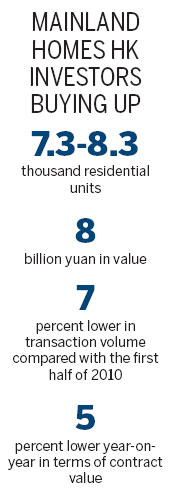

In the first half of 2011, Hong Kong residents bought between 7,300 to 8,300 residential units on the mainland, totaling 8 billion yuan ($1.24 billion), property broker Land Power said on Tuesday.

This was 7 percent lower by transaction volume and down 5 percent in total contract value compared with the same period in 2010, according to the broker.

Shenzhen and Guangzhou are still Hong Kong investors' favorite destinations, which together attract half of the total home purchases, followed by other cities in the Pearl River Delta (PRD) region and Shanghai.

The total number of home purchases by Hong Kong citizens is likely to reach 15,100 to 16,100 or 16.2 billion yuan this year, said Michael Choi, chairman of Land Power, who added that the estimates are down 5 percent and 6 percent respectively, compared with a year earlier.

The gloomy property market in first-tier mainland cities have dampened the enthusiasm of Hong Kong investors, Choi added.

Data provided by Land Power shows that home prices in Shanghai, Beijing, Guangzhou and Shenzhen have decreased by 9 percent, 8.9 percent, 6.8 percent and 4 percent in the first half respectively, in comparison with the first half of 2010.

"Some large cities have also announced a home price cap, which would inevitably further cool the market in the second half as well as Hong Kong people's property investment on the mainland," Choi told a media briefing in Hong Kong on Tuesday.

The central government has imposed a series of measures to cool the market, including lifting interest rates and limiting the number of purchases as home prices have continued to climb since 2009.

On July 19, the mainland-based 21st Century Business Herald reported that Shenzhen has set a tough "zero increase" target for property prices by August 1, 2011, harsher than the previous policy of targeted annual rises.

However, the Shenzhen Urban Planning Bureau denied this, according to a report by Down Jones. Nevertheless, curbs on property and lending have dented Shenzhen's appeal for Hong Kong investors. Only 1,800 to 2,000 home purchases were recorded through June 30, compared with 2,000 to 2,200 during the same period in 2010, according to Land Power.

Yang Qiu, director of the Real Estate Research Center at the Chinese Real Estate Association, told China Daily that Hong Kong people mainly bought homes for private use or as an investment but that the number of the latter was significantly higher.

"Market sentiment is crucial to Hong Kong investors. As home price increases have now halted in major cities, most investors from Hong Kong will choose to wait and make decisions when the market condition becomes clearer," said Yang.

The central government will continue to implement property tightening measures to discourage speculators and restrict house purchases in more second and third-tier cities that have witnessed excessive property price growth, according to a statement released on July 14.

China Daily

(HK Edition 07/27/2011 page2)