Mainland buyers snapping up local homes in record numbers

Updated: 2011-07-26 08:05

By Oswald Chen(HK Edition)

|

|||||||

|

Residential buildings in the Tung Chung district of Hong Kong. Centaline Property said the share of mainland buyers in terms of total transaction numbers reached 9.6 percent in the first half. Jerome Favre / Bloomberg |

Curbs on the property market north of the border making city a popular choice

Mainland property buyers continue to be a driving force in the local property market, buying up homes in record numbers in the first half of the year, according to a report issued by a city-based realtor.

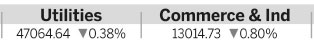

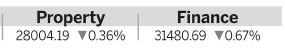

The research report, compiled by Centaline Property Agency, said that in the first half of 2011, the share of mainland home buyers in terms of the transaction numbers rose 1.9 percentage points to 9.6 percent. Meanwhile, in terms of transaction volume, their share increased 2.1 percentage points to 15.4 percent compared with the second half of 2010.

"As the mainland authorities are intensifying their efforts on cracking down on soaring home prices on the mainland by levying more restrictions, mainland home buyers are turning to the local home market where there are less restrictions," Centaline Research Director Wong Leung-sing said.

Regarding the primary market segment, the share of mainland home buyers by property transaction numbers and transaction volume rose to 27.1 percent and 32.4 percent, up 3 percentage points and 2.3 percentage points respectively compared with the six months to December 31, 2010.

Mainland home buyers are less active in the secondary market however as their share of home transaction number and transaction volume was 8.1 percent and 11.6 percent, up a modest 1.6 percentage points and 2.2 percentage points respectively compared with the second half of 2010.

"Even though the government has abolished real estate as a permissible asset class, it has not deterred mainland investors' enthusiasm for local property investment," Wong added.

The Hong Kong government scrapped investment in property as part of the Capital Investment Entrant Scheme during Chief Executive Donald Tsang's policy address last October. It was done to assuage concerns that mainland home buyers are driving up local home prices.

One academic also argued that the local home market will continue to attract mainland capital due to an interplay of factors including liquidity, investment channels, property quality and market demand.

"While mainland investors are flush with cash, the channel to make investments is limited. After the Lehman mini-bond fiasco, mainland investors are also being cautioned against making investments in financial products," said Simon Lee, a senior instructor in the business administration department at the Chinese University of Hong Kong.

"As a result, mainland investors are turning their eyes to the local property market on it can offer stable rental return robust demand for "renting-out" properties to foreign expatriates stationed in the city," Lee said. "The quality of properties and the investor protection mechanism in the city also fare better than the mainland so they regard local properties as yielding better investment value."

Local home prices have soared more than 70 percent since the beginning of 2009, fuelled by low interest rates, tight land supply and an influx of mainland home buyers. To rein in swelling home prices, the Hong Kong government and the Hong Kong Monetary Authority (HKMA) have introduced various measures to cool down the sizzling home market.

The Hong Kong government has mainly concentrated on boosting land supply to tackle the situation. It announced on Monday that it will auction two residential land sites in Tseung Kwan O and Yuen Long on September 6 that can provide residential flats for not less than 1,130 occupants.

The HKMA has tightened underwriting standards of mortgage lending to curb excessive property demand. The HKMA announced on Monday that new mortgage loans drawn down during June decreased by 9.4 percent to HK$24 billion compared with May, while new mortgage loans approved in June fell by 16 percent month-on-month to HK$26.6 billion.

China Daily

(HK Edition 07/26/2011 page2)