Exchange Fund reverts to gains in first half on currency returns

Updated: 2011-07-22 06:33

(HK Edition)

|

|||||||

|

Buildings in the Central district. The global investment environment will remain complicated in the second half of the year, Hong Kong Monetry Authority Chief Executive Norman Chan said. Mike Clarke / AFP |

City posts HK$46.3b profit vs HK$1b loss a year ago

Hong Kong, whose foreign-exchange reserves are the world's seventh largest, posted first-half investment income of HK$46.3 billion on returns from foreign-currency assets, compared with a loss of HK$1.0 billion a year earlier.

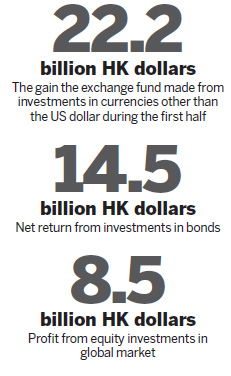

The Hong Kong Exchange Fund recorded a HK$22.2 billion gain from investments in currencies other than the US dollar, after reporting a HK$24.3 billion ($3.12 billion) loss in the first six months of last year, thanks to the appreciation of other currencies against the greenback, the Hong Kong Monetary Authority (HKMA), the city's de facto central bank, said in a statement on Thursday.

The US dollar depreciated against 15 of the world's 16 major currencies in the first half of the year, according to data compiled by Bloomberg.

A HK$14.5 billion net return from its investment in bonds also helped shore up the performance of the Exchange Fund, which is used by the Hong Kong Monetary Authority to back the Hong Kong dollar.

Meanwhile, investments in equities, both in Hong Kong and overseas markets, brought a net gain of HK$8.5 billion.

Despite the investment gains in the first half, the HKMA warned of a rocky road ahead for the fund.

The investment environment will remain complicated in the second half of the year, Norman Chan, chief executive of HKMA, said in the statement. "The pace of economic recovery in the US is likely to be more subdued than expected," he reckoned, citing a depressed housing market, a persistently high unemployment rate and the fiscal deficit problems.

Jitters about the contagion risk from the sovereign debt crisis in Europe may also cause volatility in the financial markets from time to time, he said.

Meanwhile, emerging markets are scrambling to take stronger measures to deal with massive inflows of funds and rising inflationary pressures, which can affect the flow of funds and the pace of economic growth, he added.

Hong Kong is diversifying its HK$2.4 trillion in reserve assets into emerging markets as growth slows in Europe and the United States. The US economy is likely to expand at an average rate of 3.2 percent in the six months ending December 31, according to a Bloomberg survey of economists from June 28 to July 7.

Meanwhile, the HKMA said on June 24 it received a $300 million quota to invest in the mainland's stocks and bonds through the nation's Qualified Foreign Institutional Investor program.

The US economy, the world's largest, expanded 2.3 percent in the first quarter from a year earlier, the slowest in 12 months, while the Eurozone area rose 2.5 percent. China's gross domestic product grew 9.7 percent.

At the end of June, the total assets of the Exchange Fund stood at HK$2.433 trillion, an increase of HK$88.2 billion compared with the end of 2010.

Bloomberg - China Daily

(HK Edition 07/22/2011 page2)