Property shares dip on mainland curbs

Updated: 2011-07-16 06:35

By Joy Li(HK Edition)

|

|||||||

|

A trader observes a display board at the Hong Kong Stock Exchange. The central government announced new measures to cool down the mainland property market. Ed Jones / AFP |

But analysts believe negative sentiment will be short-lived

The mainland's latest measures aimed at curbing property prices expanded to include the nation's smaller cities, causing a bumpy ride for related stocks listed in Hong Kong on Friday. However, analysts believe the plunge will be short-lived profit-taking by investors and actual blows to property prices will be limited.

It was unveiled on Thursday that at a State Council meeting chaired by Premier Wen Jiabao on July 12, the central government pledged to take further measures to cool down the red-hot property market. In this case it will restrict registered resident owners in the so-called second and third-tier cities from buying more than two flats if prices rise too quickly.

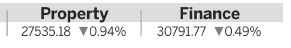

Prices of Hong Kong-listed mainland developers were hit hard during Friday's trading. Country Garden dropped 4.19 percent to HK$3.66 per share, while Poly (Hong Kong) declined 6.57 percent to HK$5.4 per share. China Overseas Land slipped 4.85 percent to HK$16.08 per share and Agile Property retreated 3.8 percent to HK$12.16 per share.

"It is like a wake-up call from the central government on speculation," said Jinsong Du, a property analyst at Credit Suisse. "Recently the market sentiment has been very buoyant as share prices of mainland developers rallied to a record high. I think it is a very timely and preemptive policy which sends out a signal that the government will remain watchful on the property market."

The sector has rallied 18 percent in the last three weeks on the back of improving contract sales in June 2011 and general expectations of no further tightening, according to Frank Chen, an equity analyst at BNP Paribas Securities (Asia) Ltd.

"This news (home purchase restrictions) could be used as an excuse for investors to take profit," said Chen, who interpreted Friday's sell-off as due to "short-term pressures".

As to the potential impact on property markets, Chen believes it will be "relatively limited," since most second-tier cities have introduced restrictions already and the enforcement by third-tier local governments will be largely discounted.

Chen holds the view that the transaction volume will gradually recover in the second half of 2011, compared with the first half.

As of the end of June, there were 41 cities that introduced restrictions, including all first-tier cities and most second-tier cities (provincial capital cities) and a few third-tier cities.

Daniel So, research analyst at Sun Hung Kai Financial, thinks that the tightening measure will not change the fundamentals.

"First-time buyers are still the dominant force in smaller cities and they are not affected by the restrictions," said So, adding that home prices in the second and third-tier cities haven't reached a bubble level yet and can be supported by improving income levels.

Credit Suisse's Du, however, takes a less bullish view and maintains that transaction volume and prices will both decline in the second half of 2011.

The People's Bank of China announced an interest rate hike on July 6, the fifth time since last October. The central bank has also lifted the required reserve ratio twice in the past two months. Other than credit tightening, the government also ensured that 10 million units of affordable housing will start construction by the end of November.

"We cannot overreact to the restrictions, however, as it is just one of a series of measures affecting the property market," Du added.

joyli@chinadailyhk.com

China Daily

(HK Edition 07/16/2011 page2)