Luxury car sector shines on bright outlook in China

Updated: 2011-07-14 08:17

(HK Edition)

|

|||||||

|

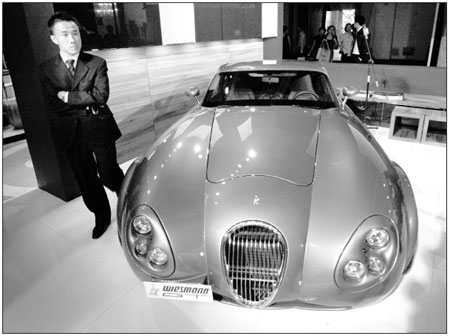

A man views a German-built sports car valued at $300,000 at a luxury fair in Shanghai. New data and forecasts promised rosy prospects for luxury-car-related companies on the mainland. Mark Ralston / AFP |

The luxury car sector stole the limelight again with investors snapping up relevant stocks in Hong Kong trading on Wednesday after new data and forecasts promised bright prospects for players.

Brilliance China Automotive Holdings Ltd surged after partner Bayerische Motoren Werke AG (BMW) lifted its earnings outlook, citing buoyant demand from overseas markets, particularly China.

Brilliance, which assembles BMW's 3 and 5 series sedans on the mainland, jumped 9.0 percent to close at HK$9.18 in Hong Kong trading, the highest close since its initial public offering in October 1999, outperforming the benchmark Hang Seng Index's 1.0 percent rally.

Munich-based BMW raised its profit and sales forecasts on Tuesday. It now anticipates sales of more than 1.6 million vehicles this year, up from a previous forecast of deliveries in excess of 1.5 million units. BMW's first-half sales in China rose 61 percent to 121,614 units, compared with a mere 3.4 percent growth for the whole auto industry.

"Luxury car sales continue to be strong, significantly outpacing other segments," said Steve Man, a Hong Kong-based analyst with Samsung Securities (Asia) Ltd, who has a "buy" rating on Brilliance. "We expect demand to outstrip supply and pricing power to remain strong over the next two to three years."

Shenyang-based Brilliance aims to triple its capacity to make BMW vehicles to 300,000 by 2013 from the end of this year by expanding an existing site and building another $789 million plant in the northeastern city.

China ZhengTong Auto Services Holdings Limited, another luxury car dealer, also boasted of a 7.8 percent gain to close at HK$9.74, also a record high since its listing in December 2010.

The car dealer is expected to book an 85 percent growth in interim profit and 118 percent gain in interim revenue, according to estimates by CCBI analysts in a research note, who have an "outperform" rating for the stock.

Dah Chong Hong Holdings Limited, which generated about 74 percent of its operating profit in 2010 from selling vehicles - mostly luxury cars, also enjoyed strong investor enthusiasm, with the stock price jumping 8.3 percent to HK$9.65.

Vehicle sales on the mainland jumped 32 percent last year as government stimulus measures and economic growth of 10.3 percent helped the nation remain the world's largest auto market for a second year. The nation's luxury-car segment grew 48 percent in the same period, according to industry consultant JD Power and Associates.

However, auto sales have increased at a slower rate this year after the rapid growth in 2010 as the government phased out incentives and imposed purchase restrictions to curb traffic congestion.

The nation's vehicle sales may expand about 5 percent this year, compared with an earlier estimate for 10 percent to 15 percent growth, Zhu Yiping, head of the statistics department at the China Association of Automobile Manufacturers, said last Friday. This makes the luxury car sector more of a standout in the industry.

China Daily - Bloomberg

(HK Edition 07/14/2011 page2)