Reverse mortgage loan scheme begins

Updated: 2011-07-12 09:14

By Oswald Chen(HK Edition)

|

|||||||

|

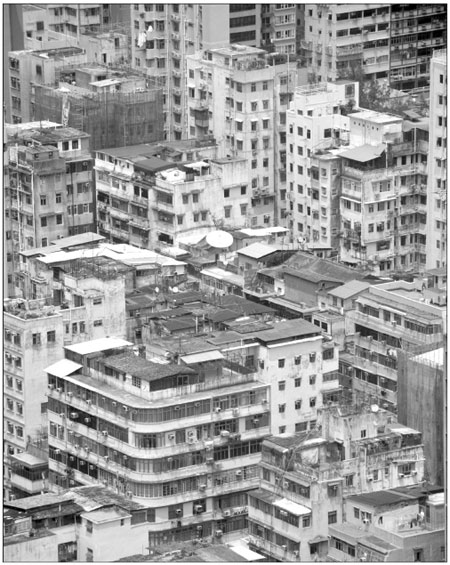

A view of old buildings in Kowloon. Four banks started receiving applications for reverse mortgage program, which aims to provide another income source for the elderly community. Antony Dickson / AFP |

Program aims to give people aged 60 plus additional income source

The Hong Kong Mortgage Corporation (HKMC) launched its reverse mortgage program (RMP) on Monday as seven banks took part in the signing ceremomy attended by deputy chairman of the HKMC and chief executive of the Hong Kong Monetary Authority, Norman Chan.

"Reverse mortgage is a brand new loan product to serve the elderly people in Hong Kong," Chan said. "According to the projections of the Census and Statistics Department, the elderly dependency ratio in Hong Kong (i.e. the number of persons aged 65 or above relative to the number of persons aged between 15 and 64) will drop significantly from 1:5.6 to 1:2 thirty years later. This demonstrates the importance of the need for elderly people to do financial planning."

Wing Lung Bank, Bank of China (Hong Kong), Nanyang Commercial Bank and Bank of East Asia started receiving applications for the scheme on Monday while Bank of Communications Hong Kong Branch, Standard Chartered Bank (Hong Kong) and Wing Hang Bank will launch their products very soon. However, other local mortgage loan providers, such as HSBC, Hang Seng Bank, Citibank (Hong Kong) and DBS (Hong Kong) are not participating.

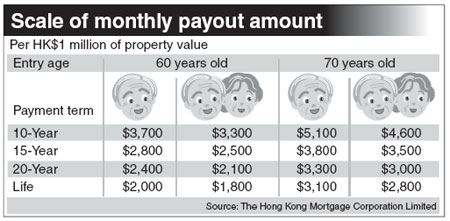

A reverse mortgage loan enables home-owners age 60 and above to utilize the property they live in as collateral to receive a fixed amount of cash from participating banks. The money is meant as a supplemental form of income every month during their lifetime or over a specified period of time - 10, 15, or 20 years. At the same time, they can stay in their own home for the rest of their life and during that time need not worry about repayment of the loan or the interest.

When the property is sold off in future and if the sales proceeds exceed the outstanding principal and issue, the surplus will be given to their inheritors.

The interest rate to be charged by banks on the loans will be the Hong Kong Prime Rate minus 2.5 percent per annum. They are also required to pay the upfront and monthly mortgage insurance premium to HKMC to ensure that it can cover the shortfall between the estimated market value of the property and the actual proceeds.

"One feature of the scheme is that changes in property values or market interest rates will not affect the monthly payouts to the elderly when the terms of the reverse mortgage loan is determined, so that it can offer key protection to the elderly," HKMC Chief Executive Officer James Lau said in the Monday press conference.

"The elderly can even take advantage of the rising property prices. By undertaking refinancing through switching their reverse mortgage loans to other scheme providers, they can secure higher monthly payouts provided they pay the handling fee, the property valuation fee and other legal costs," Lau added.

However, Harris Fraser Research Director Andy Lam told China Daily that the reverse mortgage plans has its drawrbacks.

"The scheme may not be attractive to those elderly because after deducting the interest expense and the mortgage insurance premium, the monthly payouts may not be great enough to supplement their daily expenses," he said. "For owners of those properties which are over 50 years, the monthly payouts may be even lower because the estimated market value may be low," Lau cautioned, adding that market demand for the scheme may be low.

oswald@chinadailyhk.com

China Daily

(HK Edition 07/12/2011 page2)