Safe as houses?

Updated: 2011-07-08 06:35

By Oswald Chen(HK Edition)

|

|||||||||

With mortgage rates on an upward trend, property market yields are falling. The traditional strategy of "purchasing to let" no longer looks like a sure winner. Oswald Chen reports.

Daisy Yip is a 35-year old clerk who bought a residential unit at North Point's Health Garden in February to rent out. However, she admits that any further mortgage rate hikes will make the rental income insufficient to cover mortgage loan repayments in the future.

The North Point residential unit cost Yip HK$3.98 million. She arranged a mortgage loan with a 30 percent down-payment. In other words, she took out a mortgage loan of HK$2.78 million with an interest rate of 2.13 percent.

"The current monthly mortgage loan repayment is HK$14,500 and the monthly rental income is HK$14,200, excluding other associated property maintenance costs. You can see that if the mortgage loan interest rate rises further, the rental income I received may not be sufficient to cover the mortgage loan repayment," Yip told China Daily.

"I think the trend of mortgage rate hikes in the city may hinder more people from engaging in property investing as the cost of making property investment is going to outweigh the benefits," she added.

Yip is just one of many local property investors who are confronting the fact of falling rental yields in the local property market as rising home prices crimp their returns. Home prices have skyrocketed nearly 70 percent since the beginning of 2009, fuelled by record-low interest rates, an influx of mainland buyers and tight land supply.

"Purchasing properties to rent is definitely not an attractive investment right now as the current hike in rental income cannot keep pace with the skyrocketing home prices, which in turn compress local rental yields to lower levels," said David Tse, the chairman of the Royal Institution of Chartered Surveyors (RICS) Hong Kong housing task force.

The rental yield from holding properties is defined as the annual rental return from a property over a year. It is expressed as a percentage of the property's purchase price. The net rental yield is the annual rental income subtracted by other monetary costs associated with property investing such as rates and land tax, property management fees, cleaning and repairs, mortgage payments, rental taxes, home insurance and other utility bills.

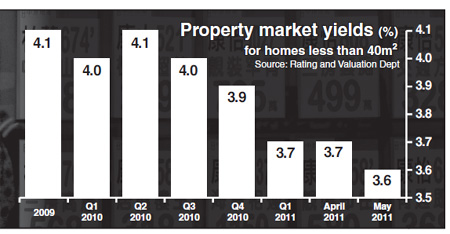

According to a report released in June by the Rating and Valuation Department, the rental yields of private residential flats in the city generally started to decline in late 2009.

For residential flats less than 40 square meters, rental yields have declined from 4.2 percent in November 2009 to 3.7 percent in April 2011 and registering a decline of 12 percent in the period, the report showed. The rental yields of luxury flats are even more unattractive, as their rental yields are hovering around 2.4 to 2.6 percent in the period from November 2009 to April 2011.

The data of the Rating and Valuation Department matches the statistics of local property agents such as Centaline Property Agency and Midland Realty, which also show that local rental yields are exhibiting a declining trend. Based on Centaline statistics, local rental yields have slumped 12.5 percent in the past 30 months while the Midland data showed that local rental yields have plummeted nearly 16 percent during the corresponding period.

Besides the huge surge in prices that have compressed rental yields, a spate of mortgage rate hikes is also likely to further deteriorate the situation. Local banks started a flurry of mortgage rate hikes in April as they face higher capital costs due to strong credit growth and monetary policy tightening aimed at combating spiraling global inflation. Thus, ballooning mortgage repayments will further elevate the investment costs for property investors.

As a result, property analysts have cautioned that local property investors should manage their interest rate risks properly by accumulating adequate cash to repay mortgage loans amid any future possible changes in mortgage rates.

"Local property investors should not solely rely on rental income to cover their mortgage loan payment costs as mortgage rates may hike more than expected. They should not expect their property investments can always yield positive carry (rental payments which exceed mortgage repayments and other monetary costs and hence generate positive cash flow) in every situation," Midland Realty Chief Analyst Buggle Lau told China Daily.

"We forecast residential flats' rental income in 2011 can generally only grow by 4 to 5 percent so that any further hikes in mortgage loan rates will further squeeze the rental income of property investors," Lau added.

Falling rental yield makes "purchasing properties for rent" increasingly unattractive as an investment option. If the local rental yield is to rise to an attractive level, it would mean that local home prices should see a significant downward correction.

"Hong Kong's rental yield jumped to a level above 5 percent in 2003 when local home prices plunged to a low level affected by the outbreak of Severe Acute Respiratory Syndrome or SARS disease," Centaline Property Agency Research Director Wong Leung Sing told China Daily.

And yields are what Yip is worried about. Her fears also show the paradoxical relationship between rental yields and home price movements in the property investment process. "Even though the rental yield is low, it is still a good investment compared to the ultra low deposit rate in the city. However, if the local rental yield rises because of falling home prices, I will suffer a loss when I sell the property even though the rental yield return has improved," Yip said.

Investment bank Barclays Capital said earlier in June that local home prices may decline 10 to 20 percent in 2012 and a further 10 percent in 2013 as further mortgage rate hikes may squeeze out marginal home buyers.

Local home prices may fall due to a series of tightening measures by the city's de facto central bank, the Hong Kong Monetary Authority (HKMA). The HKMA tightened down-payment ratios for homebuyers for the fourth time since 2009 in June as it levied restrictions for the first time on non-local residents who wish to purchase flats in the city.

oswald@chinadailyhk.com

(HK Edition 07/08/2011 page2)