Private sector softens on weak orders

Updated: 2011-07-07 08:02

By Emma An(HK Edition)

|

|||||||

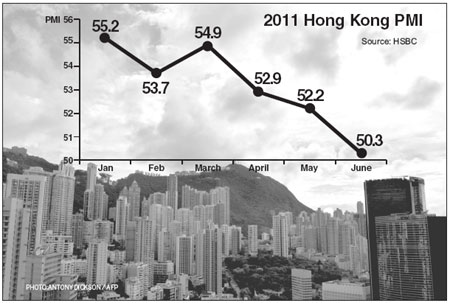

With PMI at 50.3 in June, city private sector growth at a near two-year low

The city's private sector economy grew at its slowest pace in almost two years in June as new orders declined for the first time in two years due to weaker domestic demand.

At 50.3, Hong Kong's PMI score for June represented the lowest mark in just under two years though it still remained in expansion territory, the latest HSBC survey on purchasing managers released on Wednesday shows.

The reading for May was 52.2. A score above 50 indicates expansion, while a reading below that points to contraction.

A bellwether of the city's manufacturing activity, the latest PMI reading signaled only a marginal improvement in overall operating conditions for companies in Hong Kong.

"Consistent with other regional markets, Hong Kong is navigating through near-term turbulence in the global trade cycle," Mark McCombe, chief executive of HSBC Hong Kong, said in a statement on Wednesday.

The HSBC Hong Kong PMI is compiled based on five individual indexes, namely new orders, output, employment, suppliers' delivery times and the stock of items purchased.

Shrinking new orders was the main culprit for the dip in the headline index for June.

For the first time since June 2009, the sub-index for new orders fell below the 50 neutral mark, indicating the first contraction in two years in new business received by Hong Kong companies.

Domestic demand came in weaker than that for May, while growth of new orders from the mainland was the slowest in four months.

Output by the city's private sector rose despite falling levels of new orders. But the month-on-month increase was the slowest in two years.

The pace of job creation remained little changed since May. Overall cost inflation in June meanwhile retreated for the first time since February. But inflationary pressure is still very much a factor, with 34 percent of the surveyed companies reporting higher input prices compared with the previous month.

Higher prices for a number of raw materials were responsible for a steep rise in the average price of inputs. Average wages continued to climb. The rate of growth, despite easing from May, remained sharp.

But McCombe also cautioned against accelerating inflation, which he said could chill consumer spending.

"Evidence is also emerging that escalating inflation pressures may be starting to cool household purchasing activities, although we do see positive employment and wage growth providing a counterbalance," he said.

City's inflation hit a 34-month high in May at 5.2 percent, underpinned by rising rents and food prices.

emmaan@chinadailyhk.com

China Daily

(HK Edition 07/07/2011 page2)