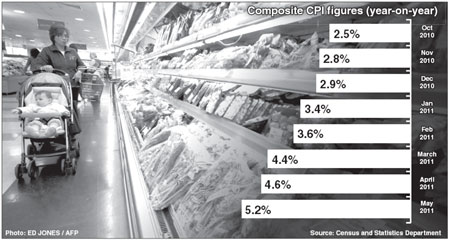

May inflation hits 34-month high

Updated: 2011-06-22 07:46

By Oswald Chen(HK Edition)

|

|||||||

Higher food prices and rents cited as main components

The city's inflation rate has reached a 34-month high as spiralling food prices and higher private residential rents are having a big effect on Hong Kong's economy.

Local economists warned that inflation may continue to increase and peak sometime in the third quarter of this year.

Overall consumer prices, as measured by the composite Consumer Price Index (CPI), rose by 5.2 percent in May compared with the same month a year earlier and larger than the corresponding increase of 4.6 percent in April, the Census and Statistics Department said on Tuesday. Taking the first five months of 2011 together, the composite CPI rose by 4.3 percent compared with a year earlier.

May's inflation rate represented the largest increase since the 6.3 percent hike seen in July 2008.

Netting out the effects of all the government's one-off relief measures, the underlying inflation rate in May 2011 was 5.1 percent on a year-on-year basis, also larger than the 4.4 percent hike in April.

"Consumer price inflation went up notably further in May. Higher food prices and the sustained pass-through of higher private residential rents remained the two key driving forces of higher price inflation," a government spokesman said in a statement on Tuesday.

"The rising inflation in Hong Kong has to be viewed against the background of elevated global food and commodity prices amid abundant liquidity and the continued robust expansion of the local economy. Indeed, inflation is currently a common challenge facing many other Asian economies," the spokesman added.

The government revised its full-year 2011 CPI forecast when it announced its first quarter gross domestic growth data in mid May. The government revised upwards its underlying inflation forecast to 5.5 percent from the 4.5 percent predicted by Financial Secretary John Tsang in his budget speech in late February.

Irina Fan, Hang Seng Bank senior economist, attributed the surge in local inflation to the robust growth in domestic consumption and the weakness of the US dollar that fuels imported inflation in the city.

"Local people are eager to spend more due to the improved job market, global food and oil prices are still hovering around high levels and local rents are still rising," Fan told China Daily. "So all these factors contributed to higher prices through the sustained feeding of higher food prices, higher energy costs and higher rent payments."

Fan predicted that the local inflation rate may peak at 6 percent in the third quarter, adding that the high inflation rate may sustain for a period of time after it reaches its peak level.

Amongst the various CPI components, alcoholic drinks and tobacco have registered 19.8 percent year-on-year increases in prices in May 2011, mainly due to the increase in tobacco duty by 41.5 percent. The prices of food items (excluding meals bought away from home) have recorded a year-on-year increase of 10.1 percent. The prices of utility bills (electricity, gas and water) have hiked 7.9 percent. Clothing and footwear have risen by 7.1 percent while housing prices have surged by 6.1 percent.

On the other hand, durable goods recorded a year-on-year 4.1 percent decrease in their prices in May.

The government spokesman added that inflation is likely to increase further in the coming months, amid higher price pressures on both the external and domestic fronts.The government will remain vigilant on the inflation situation, particularly its impact on lower-income people, he added.

China Daily

(HK Edition 06/22/2011 page2)