HKMA: Rising yuan not a threat

Updated: 2011-05-31 06:51

By Oswald Chen(HK Edition)

|

|||||||

Norman Chan says growth mostly due to increase in trade settlement volumes

Hong Kong's de facto central bank, the Hong Kong Monetary Authority, has refuted the assertion that the strong growth in the city's yuan deposits is a sign that the local currency is being marginalized.

In an article published on its website on Monday, HKMA Chief Executive Norman Chan said that the rise is burnishing the territory's status as the nation's offshore yuan center and won't undermine confidence in the local dollar.

Chan also said that the surge in yuan deposits is mainly due to rising trade settlement volumes rather than local firms dumping the local currency.

According to Chan, deposits by these clients are mostly yuan funds remitted by mainland enterprises into banks in the city to pay for imports of goods and services, rather than conversion from Hong Kong dollars by local firms.

At the end of 2010, yuan deposits in the city swelled to 310 billion yuan compared with 60 billion yuan in the early part of the year. Of the 250 billion yuan increase in yuan deposits in 2010, 180 billion yuan came from deposits made by corporations while the rest were accounted for by individuals.

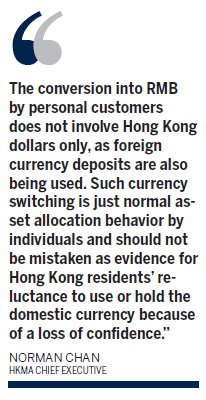

"As for RMB deposits from personal customers, some of them do come from conversion of Hong Kong dollars for payment, savings or investment purposes. But again the conversion into RMB by personal customers does not involve Hong Kong dollars only, as foreign currency deposits are also being used," said Chan. "Such currency switching is just normal asset allocation behavior by individuals and should not be mistaken as evidence for Hong Kong residents' reluctance to use or hold the domestic currency because of a loss of confidence."

Trade settled in yuan through Hong Kong made up more than 80 percent of the mainland's total yuan trade settlement in the first quarter of 2011, up from 70 percent in full-year 2010, the HKMA's chief said.

As of the end of April, total yuan deposits in Hong Kong clocked in at 510 billion yuan, representing around 8 percent of the total deposits in Hong Kong, compared with 310 billion yuan at the end of 2010.

Yuan bond issuance in the first four months of 2011 in Hong Kong also reached 18.5 billion yuan, approximately equal to 52 percent of the total in 2010, the HKMA said, adding that more diversified debt issuers and investors from Asia, Europe and America are showing increasing interest toward offshore yuan bond investment in the city.

"Significant growth in yuan deposits and in other channels of financial intermediation in Hong Kong indeed demonstrates our success as an international financial center and offshore RMB business center," Chan said.

HKMA's Chan said that Hong Kong people's confidence in the local currency is still strong, as the value of Hong Kong dollar banknotes in circulation at the end of 2010 amounts to HK$227 billion, representing around 13 percent of the city's gross domestic product.

However, some Hong Kong residents have criticized their local currency's peg to the US dollar as the latter has lost a significant amount of value in recent years, due partly to extremely loose US monetary policy.

Furthermore, some critics say the peg is helping to stoke inflation that would otherwise be softer if the Hong Kong dollar were allowed to appreciate.

Reuters and Dow Jones contributed to this story.

China Daily

(HK Edition 05/31/2011 page2)