Gome sees upside for margins as profit soars

Updated: 2011-05-27 06:18

(HK Edition)

|

|||||||

Gome Electrical Appliances Holding Ltd, China's second-largest electronics retailer, expects its gross margin to "trend up" this year, acting Chief Financial Officer Fang Wei said on Thursday.

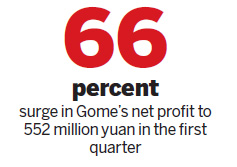

Fang made the remarks during a conference call after the company reported a 66 percent rise in its net profit for the first quarter.

Fang also said the company's target of opening 260 new stores this year would be "very likely" reached. It had 30 net store openings in the first quarter, he said.

The company is also targeting 1 billion to 1.5 billion yuan in capital spending for 2011 and has "no need" to raise capital for operational purposes, Fang said.

The Beijing-based company said net profit for the three months to March 31 surged 66 percent to 552 million yuan from 332.6 million yuan a year earlier, as it expanded online and into smaller cities. Sales gained 16 percent to 13.7 billion yuan over the period.

Gome has focused on opening stores in smaller mainland cities and tapping into the Internet-commerce market in a bid to compete with larger rival Suning Appliance Co. Gome said May 25 that it wants online sales to account for more than 10 percent of revenue in two to three years, and will keep prices competitive through bulk purchases from its suppliers.

The stock slid 0.7 percent to close at HK$2.81 in Hong Kong, compared with a 0.67-percent gain for the Hang Seng Index. Gome's shares have climbed 25 percent in the past year.

Former chairman Chen Xiao stepped down in March after losing a battle with the company's jailed billionaire founder, Huang Guangyu, over the pace of store openings.

Chen said this month the company is overcharging suppliers and its plan for new store openings is impossible to reach, the 21st Century Business Herald reported May 11.

Huang, also known as Wong Kwongyu, and his wife Lisa Du Juan own 32.2 percent of Gome, while Bain Capital LLC holds 9.9 percent, according to data compiled by Bloomberg.

Bloomberg

(HK Edition 05/27/2011 page2)