CLP posts 23% first quarter gain in revenue

Updated: 2011-05-18 07:00

By Carmen Zhang(HK Edition)

|

|||||||

|

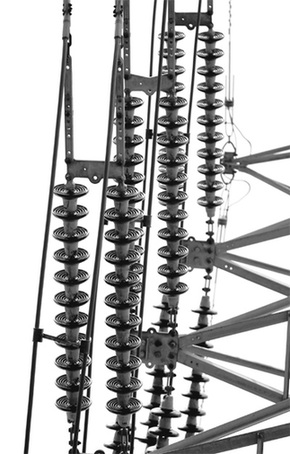

An electricity pylon in Australia. An analyst said newly acquired energy assets in the country and a robust Australian dollar will help CLP's development. Ian Waldie / Bloomberg |

Australian operations give boost to power firm's results

CLP Holdings Limited, a Hong Kong-based electricity provider, reported 23 percent growth in its first quarter revenue on Tuesday, thanks to its business expansion and higher tariffs in Australia.

Revenue for the three months ended March 31 was HK$16.48 billion ($2.12 billion), up 23.1 percent from HK$13.39 billion during the same period of last year. The main contributor of revenue came from its energy businesses outside Hong Kong, which totaled HK$9.95 billion, up 42.2 percent year-on-year compared with HK$6.99 billion in 2010.

"This performance is in line with market expectations. Though we can't give the specific figures at the current stage, we can forecast that the company's continuing growth in the coming year will be driven by its overseas business, especially in Australia," said Peter Yao, a utility analyst at Bank of China International, commenting on CLP's results.

The newly acquired energy assets in the state of New South Wales (NSW) and a robust Australian dollar will help the company's development, he added.

According to the company's quarterly statement, the profits from its Australia business were gained through higher retail electricity and gas prices, the incremental revenue of HK$2,203 million from the recently acquired energy assets in NSW, and an average exchange rate that is 12.9 percent more favorable than a year ago.

On March 1, CLP's wholly-owned subsidiary TRUenergy completed the A$2.035 billion ($2.142 billion) acquisition of EnergyAustralia Retail, the largest electricity retailer in NSW, as well as other power assets.

Meanwhile, the Australian dollar has remained strong in recent months and hit a 29-year high against the US dollar recently.

Australian Treasury Secretary Martin Parkinson said recently that the Australian dollar will stay elevated for some time as it tracks high commodity prices and strong terms of trade.

Compared with its overseas business, CLP's business performance in the domestic market was less impressive, achieving only a slight 2.4 percent growth in revenue to HK$6,487 million.

In the first quarter, sales of electricity in Hong Kong were 6,217 GWh, down 2.5 percent over the same period last year. The decline in sales in the commercial, infrastructure and public services sectors was caused by the cold weather, the company said. However, it was partially offset by the improved economic climate and increase in residential sector sales as a result of a domestic heating load, according to the statement.

The company's sales to the mainland decreased 74.9 percent year-on-year to 196 GWh, which was primarily caused by the lower contract volume with the Guangdong Power Grid Corporation for 2011, the company said.

Total unit sales, local sales and sales to the mainland, decreased by 10.4 percent to 6,413 GWh.

The company declared a first interim dividend of HK$0.52 per share, the same as that of a year ago.

China Daily

(HK Edition 05/18/2011 page3)