Stocks drop as IMF cuts US economic forecast

Updated: 2011-04-13 07:04

(HK Edition)

|

|||||||

Hong Kong stocks fell for a second day Tuesday after the International Monetary Fund cut its economic growth forecast for the US and Japan, and as commodity producers dropped on lower oil and metal prices.

The Hang Seng Index (HSI) slid 1.3 percent to 23976.37 at the close, with more than six stocks falling for every one that rose on the 45-member HSI. The Hang Seng China Enterprises Index declined 1.8 percent to 13437.53. Stocks extended declines after Japan's Nuclear and Industrial Safety Agency raised its assessment of the Fukushima nuclear accident to 7.

China's consumer prices likely rose 5 percent in March, China Business Indepth reported in a flash headline on its website Monday, citing an official of the National Bureau of Statistics. The figure, together with first-quarter gross domestic product, is due to be released on April 15.

US stocks and crude prices fell Monday after the IMF cut its estimate for growth in the US, the world's biggest economy and oil consumer. In New York, the Standard & Poor's 500 Index dropped 0.3 percent Monday while futures on the US equity benchmark slid 0.6 percent Tuesday.

The US economy will expand 2.8 percent this year, slowing from 2.9 percent last year and less than the 3 percent for 2011 forecast in January, the IMF said. The Washington-based fund also cut its estimate of Japan's growth to 1.4 percent from 1.6 percent in the previous forecast after the March 11 earthquake and tsunami.

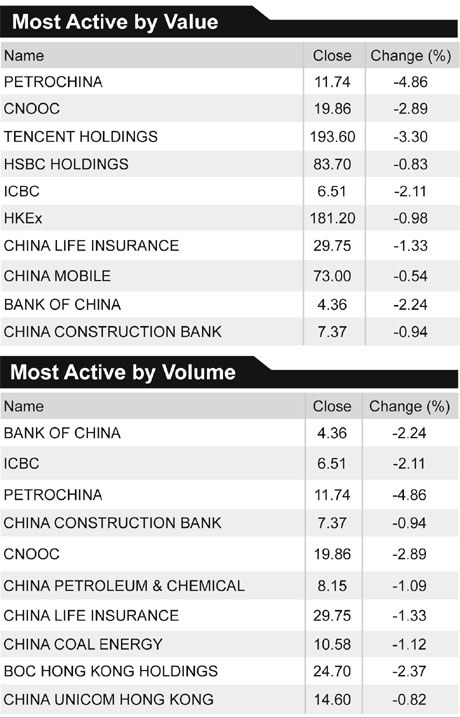

Cnooc dropped 2.9 percent to HK$19.86, while PetroChina Co declined 4.9 percent to HK$11.74. They were among the three biggest drops in the HSI.

Oil for May delivery tumbled from a 30-month high, dropping 2.5 percent to settle at $109.92 a barrel in New York Monday.

Aluminum Corp of China lost 1.8 percent to HK$7.60 after Alcoa Inc reported first-quarter sales that missed analysts' estimates. Separately, the Ministry of Finance may cut export rebates for some aluminum products to 9 percent from 13 percent, the China Securities Journal reported, without citing anyone.

Jiangxi Copper Co retreated 3 percent to HK$26.30, while Zhaojin Mining Industry Co slid 0.4 percent to HK$36.65.

The London Metal Exchange Index of prices for six industrial metals including copper and aluminum fell for the first time in five days Monday, dropping 0.2 percent.

China Telecom sank 5.2 percent to HK$4.92, its steepest drop in almost 12 months.

The HSI rose 5.5 percent this year through Monday, after positive economic data from the US and China eased concern about the nuclear crisis in Japan and tensions in the Middle East. Shares in the gauge traded at an average 12.8 times forecast earnings yesterday, compared with 14.4 times at the end of last year, according to data compiled by Bloomberg.

"There are number of concerns this week that may be keeping investors on the sideline, like the quarterly results announcement in the US and the upcoming inflation numbers in China," KGI's Kwong said.

BOC Hong Kong (Holdings) Ltd dropped 2.4 percent to HK$24.70, while Hang Seng Bank Ltd, the Hong Kong-based lender backed by HSBC Holdings Plc, slid 2.2 percent to HK$122.50 after Barclays Capital warned the city's lenders are about to face a "significant liquidity squeeze," which it said means credit is currently "mispriced".

Separately, Credit Suisse Group AG said lenders will face challenges in attracting new deposits as competition rises and rates climb.

"It is clear that the same rapid pace of credit growth is unsustainable," Norman Chan, chief executive officer of the Hong Kong Monetary Authority, said in a circular Monday. Bank credit expanded at an annualized 26 percent in the first two months of 2011 after climbing 29 percent last year, he said.

Hong Kong banks were given until the end of the month to submit their funding strategies to the city's de facto central bank amid concern that "rapid" credit growth will curb liquidity and reduce loan quality.

Futures on the Hang Seng Index lost 1.6 percent to 23968. The HSI Volatility Index, the benchmark gauge for Hong Kong stock options, jumped 6 percent to 18.17.

Bloomberg

(HK Edition 04/13/2011 page3)