Power Assets net income rises 7.42% to HK$7.19b

Updated: 2011-03-03 07:48

By Oswald Chen(HK Edition)

|

|||||||||

|

A Power Assets chimney rises over solar panels in Hong Kong. Earnings from the company's Hong Kong operations in 2010 were flat compared with 2009. Jerome Favre / Bloomberg |

Former Hongkong Electric says overseas earnings increase by 23.6%

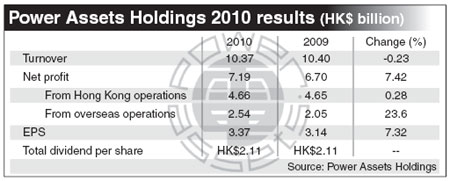

Utility provider Power Assets Holdings Limited - controlled by local tycoon Li Ka-shing - on Wednesday reported a 7.42 percent increase in its net profit for the year ended Dec 31. The company said it will pursue more overseas projects as it looks to continue to expand beyond Hong Kong.

Overseas earnings were up 23.6 percent compared with 2009 results.

Power Assets was renamed from "Hongkong Electric Holdings Limited" effective Feb 16 to reflect the company's more global outlook, it said. The firm, the smaller of the city's two electricity suppliers, provides power for Hong Kong Island and nearby Lamma Island. CLP Holdings, the larger of the two, provides power for Kowloon and the New Territories.

Meanwhile, Power Assets' net profit climbed 7.42 percent to reach HK$7.19 billion, compared with HK$6.70 billion a year ago. The group declared a final dividend of HK$1.49 per share, making the total dividend for full-year 2010 at HK$2.11 per share, unchanged from 2009.

Earnings from the group's Hong Kong operations were HK$4.66 billion, flat compared with HK$4.65 billion in 2009. Overseas earnings, however, jumped 23.6 percent to HK$2.54 billion from HK$2.05 billion. Power Assets recorded turnover of HK$10.37 billion compared with HK$10.40 billion in 2009.

Power Assets attributed the rise in its overseas profit to its acquisition of a 25 percent stake in Seabank Power Limited and a 40 percent stake acquisition of UKPN, as well as the overall higher contribution from the group's existing investments outside Hong Kong.

As of Dec 31, Power Assets' net debt was HK$19.93 billion, with a net debt-to-equity ratio of 36 percent. The company's overall capital expenditure was HK$2.43 billion in 2010.

Regarding the local operations of the group, Power Assets Chairman Canning Fok warned that higher fuel prices are expected to continue to exert pressure on fuel costs in 2011.

"We will continue to pursue further growth by actively seeking out investment opportunities in power and utility-related businesses ... with earnings from operations outside Hong Kong expected to continue to provide an increasing proportion of our overall group earnings," Fok said in the company announcement posted to the local bourse on Wednesday.

However, the company's overseas expansion plans in 2011 may have suffered a set-back when US utility provider PPL Corporation outbid Cheung Kong Infrastructure Holdings Limited - also controlled by Li Ka-shing - and Power Assets to win German utility E ON AG's UK power networks by paying $5.6 billion in cash to E ON.

In 2010, Hongkong Electric was part of the Cheung Kong-led group that paid $9.3 billion for Electricite de France SA's UK power networks.

Market analysts said that while the strategy of pursuing overseas business expansion is correct, it is a difficult task to complete an overseas acquisition successfully.

"As other utilities providers from all over the world are also actively seeking overseas expansion, it will not always be easy for Power Assets to acquire cheap power or utility assets to bolster its future profitability - so the pace of its overseas expansion may be hindered," Dickie Wong, a director at Kingston Securities told China Daily.

Reuters and Bloomberg contributed to this story.

China Daily

(HK Edition 03/03/2011 page3)