HSBC eyes 20% long-term ROE for Asia ops

Updated: 2011-03-02 07:47

By Joy Li(HK Edition)

|

|||||||||

A long-term return on equity (ROE) rate of 18 percent to 20 percent is "achievable" for HSBC Holdings PLC's Asia Pacific arm, said Peter Wong, chief executive of the lender's regional operations.

Wong was speaking on Tuesday, a day after the banking giant cut its global ROE target to a range between 12 and 15 percent.

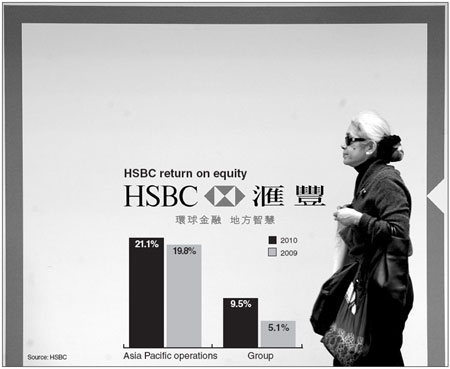

The lender's ROE in its Asia Pacific operations for 2010 was 21.1 percent, up from 19.8 percent in 2009 and more than double this year's group-wide ratio.

HSBC released its 2010 full-year result on Monday. Although its 2010 net profit rose 1.27 times to $13.2 billion, investors were disappointed as the lender's CEO Stuart Gulliver cut its ROE target from a range of 15-19 percent to 12-15 percent. The adjustment was due to stricter Basel III rules that will require banks to shore up equity holdings against possible losses. HSBC shares closed at HK$85.75 on Tuesday, down 5.14 percent, its sharpest single-day decline in a year.

The bank's local arm, the Hongkong and Shanghai Banking Corporation, meanwhile, posted a net profit increase of 27 percent to HK$57.5 billion in 2010. During the same period, net loans and advances in Hong Kong increased by HK$312 billion, or 41.9 percent, due to significant growth in corporate and commercial lending (up HK$244.3 billion). Personal lending increased by HK$63.9 billion, driven by mortgage lending which increased by HK$54.9 billion, the company reported in its annual results.

Looking at 2011, Wong expects to see economic growth in the region (ex-Japan) to reach 7.6 percent, which is "very aggressive".

"There is a lot of room for improvement and we will capitalize on opportunities," said Wong, adding that the lender's loan book will grow further this year, although it will keep an eye on risk factors such as inflation and oil price hikes amid protests in the Middle East.

In a research report issued by JPMorgan on Tuesday, analysts wrote that "HSBC is taking market share in Asia and despite the drag from its EU/US businesses, growth rates are impressive." HSBC reported $5.7 billion in pre-tax profit from local operations in 2010 while the rest of the region (excluding Hong Kong) generated $5.9 billion. The city accounted for 29.9 percent of the group's business in 2010 while the rest of the Asia-Pacific region accounted for 31 percent of the business.

Wong said the bank plans to add 15 branches on the mainland in 2011. The lender currently has some 100 outlets there. The bank will also expand in other key markets including Malaysia, Vietnam, Taiwan and Australia.

Regarding the offshore yuan business, Mark McCombe, chief executive in Hong Kong at HSBC, said that he expects it to make a material contribution to the bank in the next three to five years.

HSBC was the first bank to launch offshore yuan investment via structured products and certificates of deposit. The bank now offers yuan trade settlement in 36 markets, said HSBC.

China Daily

(HK Edition 03/02/2011 page2)