AIA beats estimates with a 54% gain in full-year profit

Updated: 2011-02-26 07:35

By Joy Li(HK Edition)

|

|||||||||

|

The AIA Central tower in Central. The company's earnings beat the average estimate of $2.02 billion by nine analysts surveyed by Bloomberg. Jerome Favre / Bloomberg |

Net income for insurance giant reaches $2.7b

AIA Group Ltd, the Asian insurer that staged the largest IPO ever seen in Hong Kong last October, reported a 54 percent surge in its full-year net profit on the back of strong premium income growth in regional markets including Hong Kong and Thailand.

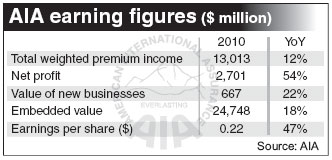

Net profit rose to $2.7 billion in the year ended Nov 30, 2010, from $1.9 billion a year ago, the third-largest insurer by market value in Asia said Friday. The earnings beat the average estimate of $2.02 billion by nine analysts surveyed by Bloomberg.

Total weighted premium income - the broadest measure of premium income - rose 12 percent to $13.01 billion from $11.63 billion.

The value of new business increased 22 percent to $667 million from $545 million. Embedded value advanced 18 percent to $24.74 billion from $20.96 billion. Embedded value, which adds the adjusted net asset value and present value of future profits of the firm, is a key measure used in the insurance industry.

Mark Tucker, AIA Group chief executive and president, said that performance in the fourth quarter was particularly strong.

"Our very successful IPO marked a new beginning for AIA which, together with changes we implemented in the second half of 2010, has helped to unleash the potential of our business and create strong growth momentum going into 2011," said Tucker.

AIA raised $20.5 billion in its Hong Kong IPO last October, the largest ever at the local bourse and the third largest globally.

Hong Kong contributed the most in terms of premium income, raking in $3.01 billion, up 5 percent from $2.86 billion in the previous fiscal year. Operating profit after tax from its Hong Kong operations increased 14 percent to $744 million from $655 million.

The value of new business created in Hong Kong was $210 million, accounting for 28 percent of the total, or the biggest chunk among all reporting regions. However, it only registered 2 percent annual growth, the lowest among peers. The company explained that this was because its margins were dragged down by high levels of demand in the second half of the year for low-margin investment-linked products.

AIA markedly boosted its Hong Kong agency team in its fiscal fourth quarter, with the number up 46 percent compared with the same period in 2009.

On the Chinese mainland, premium income increased 12 percent to $1.13 billion from $1.02 billion. Operating profit after tax remained unchanged at $69 million. The value of new business posted a stellar growth of 43 percent at $68 million.

Tucker said that the mainland certainly offers a lot of opportunities. AIA has secured approval to open eight new sales and services centers in Jiangsu and Guangdong provinces.

According to statistics from the China Insurance Regulatory Commission, premium income in 2010 was 1.45 trillion yuan, up 30.6 percent from a year ago.

And in a research report issued on Friday, analysts at KGI Securities noted that with strong growth in the value of new business and embedded value, together with a rising cycle for bond yields that can lift up asset performance, AIA's valuation is fair and supportive to its share price.

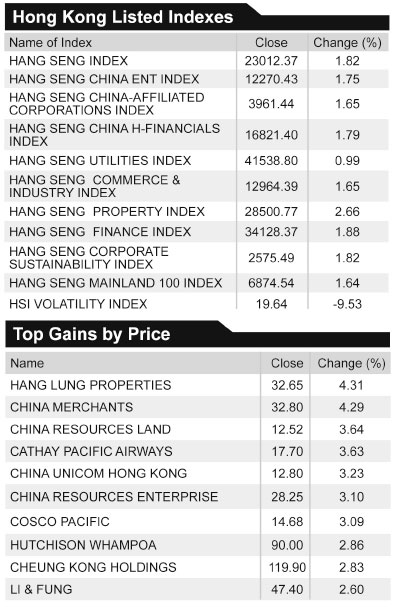

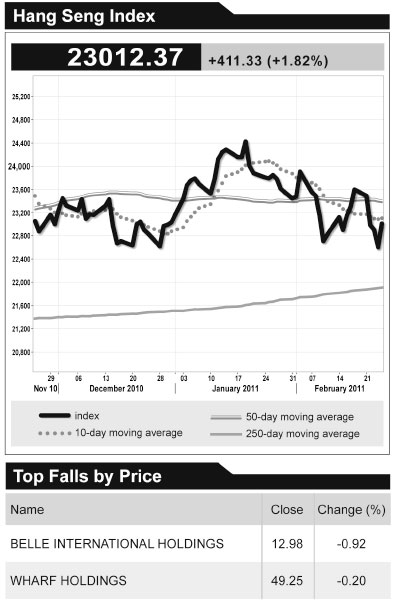

AIA closed at HK$22.30 in local trading Friday, up 5.7 percent. The benchmark Hang Seng Index closed at 23012, up 1.82 percent.

China Daily

(HK Edition 02/26/2011 page3)