Sino Land H1 net income up 62%

Updated: 2011-02-26 07:35

By Oswald Chen(HK Edition)

|

|||||||||

|

Air conditioners protrude from a residential building in the city. Sino Land expects to complete its Kowloon Bay and Hung Hom Baker Court projects in 2011. Mike Clarke / AFP |

The developer attributes gains to property sales, rental growth

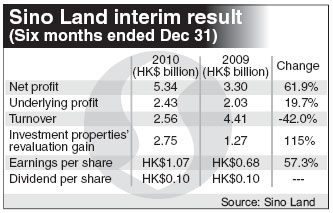

Blue chip property developer Sino Land Company Limited reported Friday that its interim net profit in the six months to Dec 31 surged 61.9 percent to HK$5.34 billion from HK$3.30 billion in the corresponding period in 2009.

The company said the stellar results were propelled by buoyant property sales and robust growth in rental income.

Meanwhile, it said that underlying profit also increased, up 19.68 percent year-on-year to HK$2.43 billion.

Earnings per share also rose 57.3 percent to HK$1.07 per share. The company declared an interim dividend of HK$0.10 per share.

During the interim period, Sino Land's turnover amounted to HK$2.56 billion, which represented a decline of 42.01 percent from HK$4.41 billion during the same period in 2009. However, with a revaluation gain on its properties of 1.15 times to HK$2.75 billion as well as earnings from the Hermitage residential project sales that have already been booked, the developer recorded strong results.

Looking ahead, the developer said it possessed sufficient land bank in Hong Kong and the mainland that can be leveraged to enhance its business development.

In the city, Sino Land has a land bank of approximately 40.9 million square feet of attributable gross floor area, of which 64.2 percent is for residential sites. On the mainland, the company's land bank totalled 25.2 million square feet, of which nearly 90 percent is for residential development.

In Hong Kong, the company expects that it can complete its Kowloon Bay and Hung Hom Baker Court projects with an attributable gross floor area of 201,200 square feet in 2011. The developer has already completed the residential development projects at the Hermitage, Sino International Plaza and Maison Rose during the six months to Dec 31.

On the mainland, the developer has residential projects in Shanghai, Chengdu, Chongqing, Zhangzhou, Guangzhou, Xiamen, Fuzhou and Shenzhen. Developments in Chengdu, Chongqing and Zhangzhou will be completed in phases throughout the next few years.

As of Dec 31, the developer's gearing ratio stood at 10.8 percent, representing a decrease of 10.7 percentage points from six months earlier due to buoyant property sales and a share placement. The company's cash-on-hand was approximately HK$7.6 billion as of Dec 31.

Sino Land Chairman Robert Ng Chee-siong said that the developer can use its competitive edge in both the local and mainland property markets.

"With the local gross domestic product rising over the past consecutive quarters, improved employment prospects, good affordability, low mortgage rates, favorable residential properties' rental yields and increasing marriages and births, the outlook of local property market is positive," Ng said in the interim report posted to the local bourse on Friday.

"The mainland is an important market for us. Demand for housing is set to grow, propelled by high savings rates, low home ownership, a strong urge to improve living conditions and the desire to own property both as storage of wealth and as an inflation hedge," Ng added.

Market analysts said the buoyancy of the local property market should secure profit growth for Sino Land in the future.

"We can see that the Hong Kong government will not introduce drastic measures to cool down the property market," said Francis Lun, general manager of Fulbright Securities. "The local property market poses less business risks to the company. Moreover, I predict the company can still enjoy huge profit margins from developing its current land bank."

Sino Land's share price climbed 2.45 percent to close at HK$14.22 per share in Hong Kong trading Friday.

China Daily

(HK Edition 02/26/2011 page2)