Reverse mortgage scheme given a polish

Updated: 2011-02-25 07:51

(HK Edition)

|

|||||||||

The Hong Kong Mortgage Corporation Ltd (HKMC) said Thursday it will enhance its planned reverse mortgage scheme in order to make it more attractive.

The government-sponsored agency announced in December 2010 that it was to launch a reverse mortgage pilot scheme by the middle of 2011.

Under the scheme, of which only limited details have been revealed, borrowers aged 60 or above who own their own property can apply for a reverse mortgage loan with approved banks and receive monthly payments for the rest of their lives. The amount would vary according to the chosen length of the mortgage term.

When the property holders die, the bank would either take control of the property, or their beneficiaries could repay the loan balance to redeem it.

However, an earlier survey by the HKMC showed that only 44 percent of local residents support the idea and less than 25 percent of the respondents would actually consider participating in the scheme.

In an apparent move to sweeten the scheme before its launch, the HKMC announced Thursday some modifications to it.

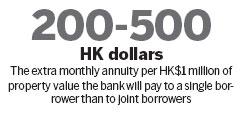

A single borrower applying for a reverse mortgage will receive a higher monthly annuity than joint borrowers - around HK$200 to HK$500 more a month per HK$1 million of property value, HKMC Director Peter Pang said.

Borrowers can make a lump-sum withdrawal of their annuity to meet certain specific expenditures, with consequent downward adjustment to the monthly annuity level, he said.

A six-month rescission period is also provided. If a borrower terminates and repays the reverse mortgage within the rescission period, the insurance premium will be waived.

The fees and charges associated with a reverse mortgage application, for example, pre-sale counselling and property valuation fees, will also be reduced where possible.

"Given the aging population, post-retirement financial planning is becoming more important. The Reverse Mortgage Pilot Scheme can provide one more alternative for the elderly to opt to receive a steady cash flow to improve their quality of life while staying in their own homes during their life time," Pang said.

China Daily

(HK Edition 02/25/2011 page3)