CFA Institute calls for better REIT governance

Updated: 2011-02-18 06:50

By Emma An(HK Edition)

|

|||||||||

Report cites conflicts of interest, lack of independent oversight

Hong Kong needs to reform the governance structure of real estate investment trusts (REIT) in order to better protect investors and facilitate the growth of its $10 billion REIT market, the CFA Institute said in a report released Thursday.

The report reviews governance practices in the four largest REIT markets in the Asia-Pacific region including Australia, Japan, Singapore and Hong Kong. Problems arising from conflicts of interest and little independent oversight over REIT operations are said to be common throughout the region.

These problems demonstrate the "weaknesses" in REIT governance that have in effect sidelined minority investors, the global organization of financial professionals noted in the report.

"Given the infancy of some REIT markets in Asia and the potential for growth in new markets, we believe better governance will help in long term value creation for the investor," Lee Kha-loon, the head of the standards and financial market integrity division for Asia Pacific at the CFA Institute, said Thursday at a media briefing.

Based on this belief, the report proposed a few changes to the existing REIT regulations.

REITs are collective investment vehicles that invest in a diversified pool of professionally managed real estate assets, which are usually considered safe and high-yield investments as they allow investors to invest in real estate without a large capital outlay while providing steady rental income through regular distributions.

In Hong Kong, the REIT market is primarily governed by the Securities and Futures Commission (SFC) and REIT code released by the SFC in 2003. Like most others in the region, REIT managers in Hong Kong are usually a wholly-owned subsidiary of a sponsor with a large holding in the REIT.

This interrelatedness increases the chance of conflicts of interest as the manager and sponsor are prone to "doing things in their best interest" at the expense of minority investors, said Angela Pica, a policy analyst at the CFA Institute. If there has to be a significant decision made on important matters such as an acquisition or a rights issue, it is usually the sponsor who will have "the last say", Pica added.

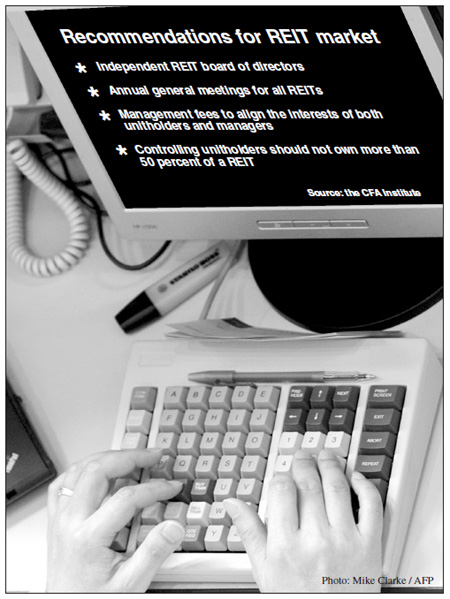

"(Minority) shareholders need to be engaged," said Pica. And for that to be the case, it is recommended that a board of directors independent of the management and sponsors be established, with mandatory annual general meetings to ensure the participation of minority investors.

Further, it is advised to limit the controlling unitholding to no more than 50 percent of the issued units. REITs are typically structured as a unit trust, and are listed and traded on a stock exchange. Investors buy units, which trade independent of the manager.

"Controlling unitholders should not own more than 50 percent of the issued units in a REIT, which is to ensure minority unitholders an opportunity to exercise their rights without being marginalized," said Pica.

Management fees should also be structured so that "managers are rewarded for good performance and penalized for poor performance", according to Pica.

In Hong Kong, a REIT manager receives a base fee, calculated as a percentage of the value of the properties managed, together with a performance fee, which is often based on net property income.

And the way performance fees are calculated is the most problematic in Pica's eyes as it will likely incentivize managers to grow the net income base while paying no heed to rising borrowing costs dragging on the distributable income growth.

She suggested linking the performance fee to actual performances such as the relative share-price performance or the growth in distribution per unit.

All these measures will help enhance investor protection, increase investor confidence and encourage more investors to invest in the REIT market, according to Pica.

The REIT market in Asia-Pacific is the second largest globally, worth around $118 billion - which represents 21 percent of global REIT market capitalization. The market in Hong Kong, with seven listed REITs worth $10 billion, is the fourth largest in the region after Australia with a market capitilization of $68 billion, Japan with $24 billion, and Singapore with $16 billion.

And having the recommended governance measures in place will "promote the growth of the REIT market", said Pica.

China Daily

(HK Edition 02/18/2011 page3)