HKEx: We're open to alliances

Updated: 2011-02-11 07:29

(HK Edition)

|

|||||||

|

A worker in front of Exchange Square in Central. The bourse operator said it will consider an international alliance. Ted Ajibe / AFP |

Recent global acquisition flurry by bourses prompts the operator's strategic rethink

Hong Kong Exchanges & Clearing Ltd (HKEx) said Thursday it will consider international alliances after Deutsche Boerse and NYSE Euronext announced plans to form the world's biggest trading powerhouse.

The city's sole bourse operator, currently the world's largest by market value, has the most cash or near cash items on its balance sheet of any listed bourse, according to data compiled by Bloomberg.

The company has not identified any immediate targets but remains open to opportunities if and when they arrive, said Lorraine Chan, a spokeswoman for the exchange.

"Due to changes in the financial market landscape, HKEx will consider international opportunities for alliances, partnerships and other relationships that present strategically compelling benefits consistent with its focus on markets in China," she said in an e-mail statement. "HKEx will not pursue alliances, partnerships or other relationships purely for investment gains," she added.

Deutsche and NYSE said they are in advanced talks to form a marketplace that would have annual trading volume exceeding $20 trillion, the latest in a flurry of mergers pointing to a shake-up of an industry under intense cost pressure from upstart electronic rivals.

News Deutsche Boerse could be close to buying NYSE Euronext came shortly after the London Stock Exchange announced a bid for Canada's TMX.

The merger activity spurred a rally in shares of Australia's ASX, which is trying to overcome domestic opposition to a $7.9 billion takeover bid from the Singapore Exchange.

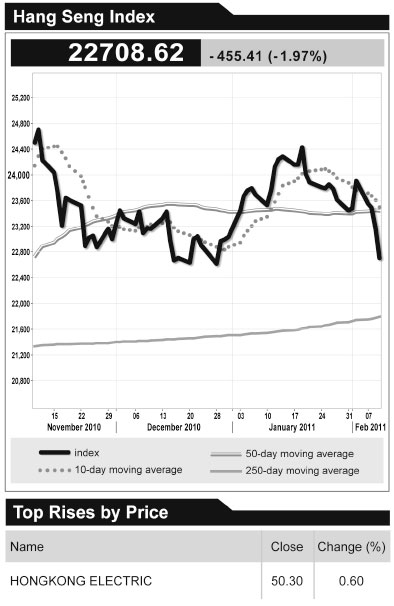

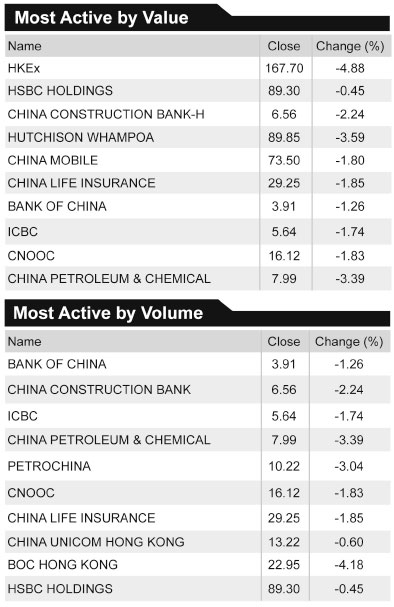

In contrast, HKEx shares plunged 4.9 percent to HK$167.70 at the close of local trading, its sharpest drop since May 14, 2009, on worries a round of mergers would intensify competition for the exchange.

HKEx has so far avoided any moves to merge because of its strong pipeline of China-backed IPOs.

The company will only consider mergers and other opportunities in the areas that it believes will enhance its capabilities in technology, business and services, HKEx's Chan said.

HKEx signed a closer cooperation agreement with the Shanghai bourse in January 2009 and with the Shenzhen Stock Exchange in April of the same year.

"After the announcement of more cooperation, they haven't made any follow-up announcements and investors are still looking for that," said Castor Pang, Hong Kong-based research director at Cinda International Holdings Ltd. "In the short term, it's quite difficult for that to happen."

Sam Hilton, a Hong Kong-based analyst at Keefe, Bruyette & Woods Asia Ltd, said while he doesn't expect HKEx to be involved in any mergers and acquisitions soon, Taiwan, Shanghai and Shenzhen bourses could be likely targets.

"For a straight-up exchange transaction, I guess the non-mainland candidates that could make sense in their stated strategic context would be those exchanges with relatively significant populations of mainland companies listed on them, or possibly Taiwan," Hilton said. "A tie-up with Shanghai or Shenzhen probably fits that strategic context the most naturally, but it seems unlikely in the near or even mid-term."

Reuters - Bloomberg

(HK Edition 02/11/2011 page3)