HSBC slashes MPF management fees on three funds by 20 to 40%

Updated: 2011-02-10 07:33

By Oswald Chen(HK Edition)

|

|||||||

Analyst: Move may trigger a price war

HSBC Insurance, the largest local Mandatory Provident Fund (MPF) provider, announced Wednesday that it is to slash the annual management fees for three of its constituent funds by 20 to 40 percent under its existing MPF schemes. The reduction in fees will take effect from March 1, 2011.

Asset managers predicted that more MPF providers will follow suit, possibly triggering a price war as they fight to maintain their market share in an increasingly competitive business.

According to a statement released by HSBC Insurance, the new management fees for the MPF conservative fund will be lowered from 1.25 percent to 0.79 percent, the global bond fund decreased from 1.25 percent to 0.99 percent, and the Hang Seng Index tracking fund slashed from 1.5 percent to 0.9 percent.

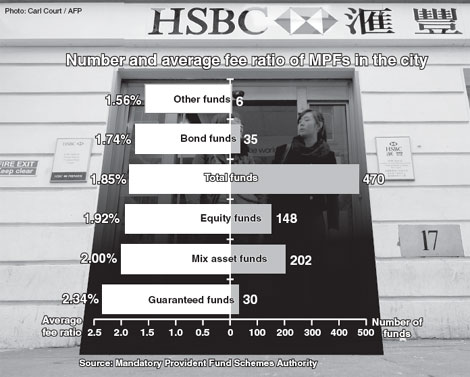

HSBC Insurance estimated that the management fee reduction will lead to a more than 10 percent reduction in the fund expense ratio (FER) for all constituent funds under the HSBC MPF schemes. The current FER for all constituent funds under the HSBC MPF schemes stands at 1.85 percent.

"Our MPF business has achieved economies of scale when our business' asset under management (AUM) level has achieved a sustainable level, so that we can afford to make huge slashes in management fees," HSBC Insurance Director Alex Chu said at Wednesday's press reception.

"The three constituent funds concerning bond and money market investments as well as index tracking only require passive investing. Therefore we can afford to lower these funds' management fees," Chu added.

"If the AUM size of our MPF business can register further growth, we can even trim the management fees for those active management funds," he said.

"I predict other MPF providers will follow suit to lower the MPF management fees to maintain their market share. Moreover, as the AUM size of their MPF business has grown, so too the providers have the financial flexibility to decrease management fees," Ernest Chan, chief investment officer at Convoy Asset Management told China Daily.

"Though the Employee Choice Arrangement (ECA) under the MPF scheme has been postponed, I think MPF providers are still aggressive in capturing market share before the ECA is launched," Chan said, adding that the possible price war in MPF fee reductions will benefit retail MPF investors.

The ECA under the MPF scheme is to allow local employees to switch fund managers once a year for their MPF contributions. It was thought that the initiative will offer better investment choices for retail MPF investors. However, the government in September 2010 announced the ECA will be postponed indefinitely as it needs more time to regulate local MPF intermediaries.

Before the price reduction by HSBC Insurance, other MPF providers such as AXA and BOCI-Prudential Trustee have also slashed their product charges recently. AXA has greatly reduced the management fees of the majority constituent funds of its MPF schemes to 0.99 percent in January. BOCI-Prudential Trustee also decreased the management fees of their 12 constituent MPF funds to 0.7 percent in 2010.

Among the local various MPF providers, HSBC Insurance is the largest leader in the market. Its MPF business' AUM swelled to HK$115 billion as of November 2010. As of the end of September 2010, HSBC Insurance's MPF market share reached 32.4 percent based on the AUM size.

China Daily

(HK Edition 02/10/2011 page2)