SFC questions IPO sponsors

Updated: 2011-01-28 06:54

By Joy Li(HK Edition)

|

|||||||

Regulatory body issues unusually strong rebuke of investment banks

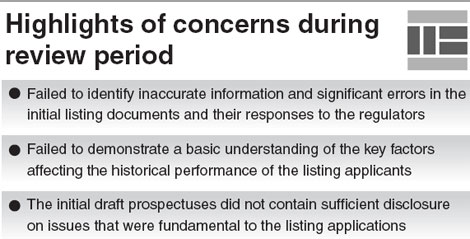

The Securities and Futures Commission (SFC) has strongly criticized the performance of investment banks that help companies list in the city, after finding that a number of IPO applications contained "material errors or omissions".

In its biannual report, released Thursday, the regulator revealed that it raised concerns about 82 of the 100 listing applications it received in the six months to September 2010.

The criticism comes hot on the heels of a blockbuster year for IPOs in the city as 87 firms raised a total of $57 billion in 2010, making the city the world's top listing destination in terms of funds raised.

"They have been much more active," said Antony Dapiran, a partner at law firm Davis Polk in Hong Kong. "It used to be that you'd rarely receive SFC comments."

Over the past two years, as companies have flocked to list in Hong Kong, the SFC has become increasingly concerned that banks and brokers are not doing enough due diligence on companies they help list.

In recent months the regulator has also been asking investment banks in the city to provide detailed records of IPOs they arranged over the past two years so they can be audited for compliance with regulations.

Some market participants expect that when the SFC announces the results of this "thematic inspection" this year, the regulator will take enforcement action against one or more banks to make an example of them.

"It would send a very clear message if there were public reprimands or naming and shaming," one dealmaker based in Hong Kong said.

In one case, the estimated capital value of the listing applicant's unsold property units disclosed in the initial draft IPO prospectus was overstated by about three times, having erroneously included the value of the units already sold, the SFC report said.

In another case, the document said a major customer had been dealing with the applicant for six years. However, it turned out the customer was incorporated only five years prior and did not place its first order with the applicant until about one year earlier. This was revealed through SFC enquiries.

"This called into question the competence of the sponsors and whether the sponsors had exercised the level of care expected of them in discharging their professional obligations," the regulator said in the report.

The regulator also reminded sponsors such as investment banks that help companies with IPOs to exercise due care and diligence, so as to "ensure that the information provided to the regulators and eventually - investors - is accurate and complete".

According to the Hong Kong IPO Guide 2010 by law firm Herbert Smith, there are no legislative guidelines at present as to what constitutes adequate due diligence. However, the Hong Kong Stock Exchange has issued guidance as to the due diligence that a sponsor should follow. However, it doesn't exhaustively set out all the steps and notes that sponsors must exercise their judgment in determining what they should investigate in each particular case.

The due diligence process generally involves three aspects, namely documentary due diligence, discussions with management and accountants and other advisers and participation in the preparation of listing materials, according to the Herbert Smith guide.

"Sponsors are expected to identify issues that are fundamental to the listing applications as part of their due diligence and to properly address the issues before submitting listing applications," said Martin Wheatley, the SFC's chief executive officer. "Even if an application does not proceed to listing because of lapse or withdrawal, provision of false or misleading information in a material particular could constitute an offence and lead to disciplinary action on the sponsor under the Securities and Futures Ordinance."

In March of 2010, the SFC ordered Hontex International, a mainland-based fabric maker, to halt the trading of its shares after the company was caught providing misleading information in its IPO prospectus.

The HK$1 billion raised by Hontex from its IPO in December 2009 was frozen by order of the High Court on April 1, 2010 - the first-ever such application made by the SFC.

The Financial Times contributed to this story.

China Daily

(HK Edition 01/28/2011 page2)