City ranked last in int'l housing affordability index

Updated: 2011-01-25 07:07

By Kane Wu(HK Edition)

|

|||||||||

SAR was only Asian market surveyed among 325 cities of industrialized world

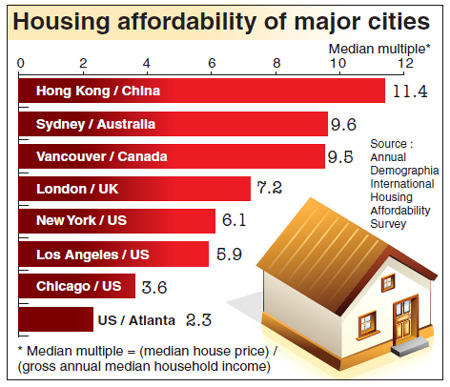

Hong Kong ranked as the least affordable market in the Annual Demographia International Housing Affordability Survey 2011 Monday.

The survey, conducted upon data in the third quarter of 2010 by the United States-based organization Demographia, covered 325 markets in Australia, Canada, Hong Kong, Ireland, New Zealand, the United Kingdom and the United States.

The survey includes Hong Kong for the first time and finds it is the least affordable housing markets of all urban markets surveyed, with the median house price at 11.4 times of the gross annual median household income, followed by Sydney at 9.6 and Vancouver at 9.5.

According to the survey standards, a city's median house price should not exceed three times of the gross annual median household income to become "affordable".

If this affordability threshold is breached, it indicates local political impediments to the provision of affordable housing that need to be dealt with, the survey report says.

By such standards, median house prices between three and four times of the annual household income are "moderately unaffordable", between four and five times "seriously unaffordable", above five "severely unaffordable".

Coming last - as the most "severely unaffordable" market in the 82 major metropolitan markets with population exceeding one million, Hong Kong's median house price is HK$2,580,000, while the median household income is HK$225,400, according to the survey report.

"The survey didn't take into account the characteristics of the Hong Kong housing systems," Professor Eddie Hui Chi-man, deputy director of the Research Centre for Construction and Real Estate Economics at Hong Kong Polytechnic University, commented to China Daily.

In the Western markets such as the US, Europe and Canada, most properties are privately owned, while in Hong Kong, a large proportion of low-income people live in public housing estates, and thus should be excluded from the private property market, Hui said.

"The median income of private house-buyers in Hong Kong could be distorted in the survey," he said.

However, Hui admitted that Hong Kong's housing price is still much higher than those in the US and Europe.

The survey report concluded that the least affordable (seriously and severely unaffordable) markets were characterized by more restrictive land use regulations, which materially increases the price of land and makes housing less affordable.

Hui, echoing this view, said that the government's measures to cool down the property market haven't proven effective.

"Now the property market is going through a counter-cooling uprising. With the inflation pressure, more investors from the mainland will come to Hong Kong for long-term investment in the property market. At the same time, short-term investors will still be active," he said.

He predicted a 5 percent to 10 percent increase in property prices in 2011.

"Given the difference in the characteristics and stage of development of individual cities, cross-economy price to income ratio should be treated with caution.We have to be very careful in comparing the affordability level of home mortgage among different economies," the Housing Authority replied in an email to China Daily.

The authority cited the International Monetary Fund Mission's report in December 2010 that Hong Kong government was much better prepared now than in any past cycle to deal with housing price pressures.

China Daily

(HK Edition 01/25/2011 page1)