Automaker H-shares take a dent on Beijing traffic control measures

Updated: 2010-12-25 07:48

By Li Tao(HK Edition)

|

|||||||

|

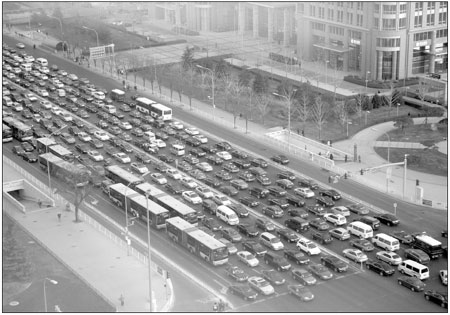

Cars and vehicles are stuck in traffic on Chang'An Avenue in Beijing. The city's authorities announced measures Thursday to limit new vehicle registrations, causing a decline in auto sector share prices. Nelson Ching / Bloomberg |

Automakers were hit hard Friday as investors dumped their stocks on worries that other cities on the mainland will follow suit after Beijing unveiled measures to limit new car registrations, a move that will effectively hurt car sales.

Brilliance China Automotive Holdings Ltd, the local partner of Bayerische Motoren Werke AG (BMW), dived 7.69 percent to close at HK$5.4 in Hong Kong trading Friday while Dongfeng Motor Group Co, one of the "top four" domestic automakers, slumped 7.75 percent to settle at HK$13.1.

Geely Auto, the listed unit of China's Zhejiang Geely Holding Group Co, dropped 6.3 percent on the same day. Great Wall Motor Co and Guangzhou Automobile Group Co were down 5.22 percent and 4.71 percent, respectively. The sector significantly underperformed compared with the 0.3 percent fall in the bench market Hang Seng Index.

On Thursday, Beijing's authorities announced measures to limit new vehicle registrations to 240,000 units next year, down about 70 percent from this year's numbers, in a bid to ease massive traffic jams in the capital city.

"The cap of 240,000 units on new vehicle registration in 2011, compared with car sales of more than 800,000 units this year, suggests that automakers are going to have a hard time in the Beijing market next year," Kenny Tang, executive director with Redford Securities told China Daily.

The Beijing automobile market accounted for about 6.9 percent of total car sales in China this year, with luxury brands such as Mercedes-Benz, BMW and other foreign brands making up the biggest share, Sina.com cited a Morgan Stanley report as saying.

Brilliance China sold 12.7 percent of its cars in Beijing and Dongfeng Motor sold about 7.3 percent, while Geely and Great Wall generated only 2.4 percent and 2.9 percent of their total sales in the city.

"The plunge in shares of Geely and Great Wall, which are less popular in the Beijing market, indicated that investors are concerned about further vehicle controls as traffic chaos is now a huge issue in many Chinese cities," said Tang.

According to a Goldman Saches research note released Thursday, Beijing's new vehicle control measures are stricter than expected. It forecasts that the new policy will hurt passenger vehicle sales in the country by around 4.5 percent in 2011.

If the annual growth rate of vehicle sales is maintained at about 10 percent to 15 percent, more mainland cities are also likely to initiate control measures in a bid to contain the soaring number of cars which pollute the air and jam the roads, Morgan Stanley said in the report.

Tang nevertheless is keeping his long-term "overweight" rating on the automobile sector due to its stellar overall growth rate.

"The Central Government strives to boost domestic consumption and the automobile industry has made a tremendous contribution to that effort. Even if car sales are likely to slow down in some big cities, I believe the second and third tier cities will remain buoyant," Tang added.

In the January to November period of this year, car sales in China rose 34.1 percent year-on-year to a record 16.4 million units - nearly three million more than that in 2009, according to the China Association of Automobile Manufacturers.

The nation overtook the US last year as the world's biggest car market with sales surging 45 percent to 13.6 million vehicles in 2009.

China Daily

(HK Edition 12/25/2010 page2)