Reverse mortgage scheme gets nod

Updated: 2010-12-17 08:01

By Oswald Chen(HK Edition)

|

|||||||

Plan aims at giving elderly another income stream

The Hong Kong Mortgage Corporation Limited (HKMC) announced Thursday that it is to launch a reverse mortgage pilot scheme in the city by the middle of 2011.

Under the pilot scheme, borrowers aged 60 or above who own their own property can apply for a reverse mortgage loan with approved banks and receive monthly payments for the rest of their lives. The amount would vary according to the chosen length of the mortgage term. When the property holders die, the bank would either take control of the property, or their beneficiaries could repay the loan balance to redeem it.

"We hope that with the introduction of reverse mortgages, the elderly can have an additional means to obtain steady cash flows to improve their standard of living while staying in their own home," said HKMC Executive Director Peter Pang.

The maximum appraised property value is capped at HK$8 million, while the property should be less than 50 years or else it will only be considered on a case-by-case basis.

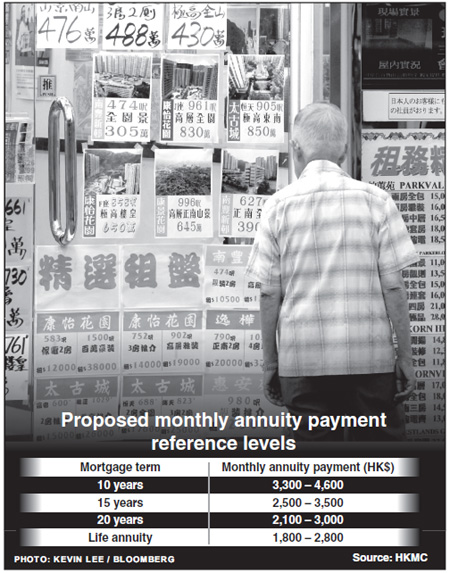

Borrowers can opt to receive monthly annuity payments over a fixed period of 10, 15 or 20 years or over their whole life span. However, they will still be held responsible for the on-going maintenance as well as the payment of rates, government rents and management fees. Additionally, borrowers will be allowed to stay in their homes even after the annuity payment term has expired.

After the borrowers die, the bank will be able to repossess and dispose of the property, according to the scheme. After disposal, if the realized value of the property (net of disposal expenses) is in excess of the total outstanding loan balance (principal plus accrued interest plus insurance premiums), the banks will give the surplus back to the borrowers' inheritors. On the contrary, if there is any shortfall, it will be covered by the insurance protection provided by HKMC.

Alternatively, the borrowers' inheritors may, within a certain period, choose to repay the reverse mortgage loan and redeem the property.

"HSBC supports any initiative that helps the elderly achieve a higher level of financial security in their later years. We look forward to seeing the details of the scheme and we look forward to providing support," said Francesca McDonagh, HSBC head of personal financial services Hong Kong, when asked to comment on the scheme.

Under the proposed pilot scheme, an effective pre-sale counseling mechanism will be devised to ensure that the borrowers will have a good understanding of their rights and obligations before drawing reverse mortgage loans.

RTHK contributed to this story.

China Daily

(HK Edition 12/17/2010 page2)