CLP unit to acquire Australian assets

Updated: 2010-12-16 08:19

By Oswald Chen(HK Edition)

|

|||||||

New South Wales government sells energy assets for HK$15.59 billion

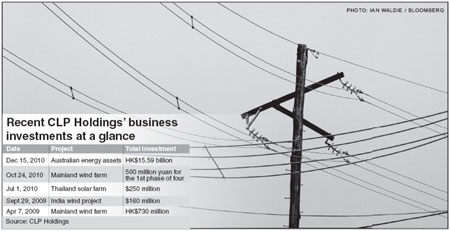

TRUenergy, an Australian-based unit of CLP Holdings, confirmed Wednesday that it is to acquire two new electricity assets and three project sites in the state of New South Wales for HK$15.59 billion by March 1, 2011.

CLP Holdings said that it will fund HK$6.39 billion through internal cash reserves and bank facilities drawdown while the remaining HK$9.20 billion will be contributed by new debt facilities taken out by TRUenergy.

Meanwhile, ratings agency Moody's announced that it is placing on review for possible downgrade the A2 issuer rating of CLP Power Hong Kong Limited and the A1 senior unsecured debt rating of CLP Power Hong Kong Financing Limited after the announcement of the deal.

In an announcement filed to the Hong Kong Exchanges and Clearing Limited Wednesday, TRUenergy's acquisition involves the energy assets of EnergyAustralia Retail, Delta Western GenTrader Bundle and three energy project sites at Marulan and Mount Piper. These assets are currently owned by the state government of New South Wales.

CLP Holdings said that the acquisition will help the group's business competitiveness in the Australian energy market.

"The acquisition will result in approximately a 119 percent increase in customer accounts for TRUenergy to nearly 2.76 million in total, and approximately a 79 percent increase in power generating capacity under management to 5,446 megawatts in total," the CLP announcement said.

"The acquisition offers an opportunity for TRUenergy to strengthen its position in New South Wales, which is the largest energy market in Australia. This is also in line with the company's objective of building a diversified and integrated energy business in Australia," the statement added.

CLP Holdings' directors considered that the terms and consideration of the acquisition are fair and reasonable and in the interests of the company shareholders, the statement said.

Financial analysts cautioned that though the purchase is one of the largest acquisitions ever made by CLP Holdings, it won't give much of a boost to revenue growth.

"As the Australian energy market is very competitive, I predict the returns from the asset purchase will only be 5 to 6 percent," said Kenny Tang, head of research and executive director of Redford Asset Management. "Though the company's market share in Australia can be raised to 20 percent, the acquisition simultaneously will lead TRUenergy's debt ratio to surge to 90 percent. Thus the company's profit margin may not increase drastically."

"The acquisition can only help boost CLP's revenue growth by 3 to 5 percent as the growth rate of the Australian energy market tends to be small," said Sincere Securities Limited Chief Executive Officer Louie Shum. "CLP should instead develop more energy projects on the mainland to capture the higher growth rate in this market."

What makes the situation worse is that the business growth of CLP in the city is very limited, he added.

"Even if CLP raises local power tariffs in January 2011, the increase in its fuel costs will constrain profit growth in the city," Tang added.

CLP Holdings resumed trading Wednesday and closed down 1.1 percent at HK$63.35. Trading in its shares was suspended Tuesday pending the announcement of the deal.

China Daily

(HK Edition 12/16/2010 page2)