BOC HK tops peers in Nov mortgage business

Updated: 2010-12-03 07:13

By Emma An(HK Edition)

|

|||||||

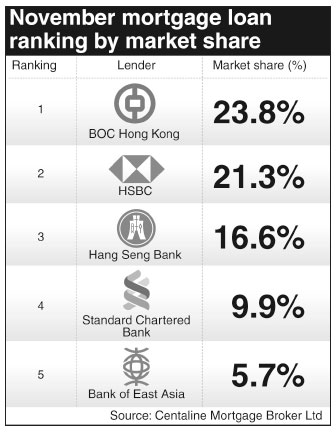

Bank of China (Hong Kong) snatched 23.8 percent of the mortgage loan business in the city last month, retaining its status as the top player in the local market.

There were a total of 16,277 mortgage loan applications in the city in November, a 5.5 percent increase compared with the previous month and up 35.9 percent from a year earlier.

It also marked the 18th consecutive month that the number of mortgage loan applications stood above the historically significant 10,000 level.

"The November uptick came after a forceful bounce back was seen in the city's property market in October," Ivy Wong, managing director of Centaline Mortgage Broker Limited, said in the latest mortgage report compiled by the company.

Its figures showed that Bank of China (Hong Kong) took top ranking in the local market with a share of 23.8 percent, representing a 1.2 percentage point gain from that of October.

The bank regained its position in October as the top mortgage loan provider in the city after finishing second to HSBC during the previous five months.

HSBC took second behind Bank of China (Hong Kong), with a 21.3 percent market share of the city's mortgage business, up 1.1 percentage points from the previous month. The top two were followed by Hang Seng Bank, Standard Chartered Bank, and Bank of East Asia, with market shares of 16.6 percent, 9.9 percent and 5.7 percent respectively.

Competition for mortgage loan business has been heating up among lenders. The reason for this is because it is low risk, Wong told China Daily. "Banks have remained keen on low-risk businesses since the financial crisis, and the mortgage business is for sure one of these kinds," she said.

For the first 11 months of 2010, HSBC was still the overall leader, taking up 19 percent of the mortgage business in the city, followed by Bank of China (Hong Kong) at 17.8 percent, and Hang Seng Bank with 15.8 percent.

And the near term is unlikely to see a slowdown. "Banks will continue to be keen on low-risk business going forward, and will keep striving for the mortgage business," Wong said. She added that a low interest rate environment is bringing more liquidity into the city and may also help boost the appetite of banks for lending, Wong added.

Home transactions lodged to the Land Registry for registration totalled 13,189 units in November, up 38.1 percent compared with October and up 43.2 percent from a year ago, the government agency said Thursday.

The total consideration for home transactions was HK$58.8 billion, up 30.9 percent compared with October and up 54.2 percent from a year ago.

China Daily

(HK Edition 12/03/2010 page3)