Inflation spike puts a hole in pocket

Updated: 2010-11-27 07:04

By Li Tao(HK Edition)

|

|||||||

Depreciating US$ makes city living more expensive

George Davey recently led a group of Australian wine makers to find potential business opportunities at the Hong Kong International Wine and Spirits Fair held earlier this month.

Davey, deputy director-general with the Department of Industry and Investment for the state of New South Wales in Australia, said he was proud about the quality of Australian wine and not at all concerned about their sales. However, he admitted that the prices of Australian wine sold in Hong Kong this year are de facto rising due to the strengthening Australian dollar.

As a result, the very same bottle of Australian wine sold in Hong Kong this year is likely to be priced notably higher than last year, as the Australian dollar this year has appreciated more than 10 percent on its way to hitting a 28-year high against the US dollar.

"We actually kept our actual export prices unchanged," Davey told China Daily.

This is just a typical example of how "imported inflation" is now affecting prices in the city as a depreciating Hong Kong dollar makes it much more expensive to purchase goods from overseas.

But the city's currency has been pegged to the US dollar through a fixed exchange-rate for almost 24 years, so there is a feeling in the city that prices hikes are inevitable. This is especially so now that the US dollar is progressively weakening against a majority of currencies - particularly its trading partners.

And not only that, but Hong Kong buys a high proportion of its goods from overseas.

"Hong Kong imported more than 70 percent of goods for self-consumption from Euro-zone, the mainland, Japan, South Korea and Singapore," said Irina Fan, senior economist at Hang Seng Bank. "Except for the euro, Hong Kong dollar has depreciated almost 3 percent to the yuan and yen, 4 percent to the won, and 9 percent to the Singapore dollar this year."

Hong Kong's services sector contributes more than 90 percent of the city's gross domestic product (GDP) - so the heavy dependence on the imported goods makes the city vulnerable to currency swings.

According to data compiled by Bloomberg, the US dollar has weakened in the past three months against all 16 major market currencies. And the situation is likely to continue, in part due to the US quantitative easing monetary policy.

Earlier this month, the US Federal Reserve decided to pump an additional $600 billion into their financial system in an effort to lift the weak economy. The US dollar then sank to a new nine-month low against the euro and also declined against other major currencies.

"The continued weakening of the US dollar is accentuating imported inflation for Hong Kong, which imports the majority of energy resources, raw materials and product components that it uses for both self-consumption and onward processing purposes," said Donna Kwok, economist for Greater China at HSBC.

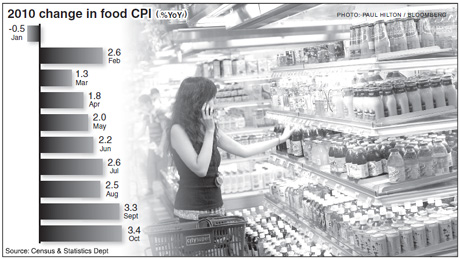

The city's underlying inflation hit a 19-month high of 2.3 percent year-on-year in October, hit hard by a 3.4 percent rise in food prices - the steepest rise since March 2009, which was "most likely due to the recent sharp spike in mainland food prices," said Kwok.

The Chinese mainland is one of the most important food export destinations for Hong Kong, but its own food prices climbed 10.1 percent year-on-year in October, according to the National Bureau of Statistics.

Although Hong Kong appears to have escaped relatively unscathed from the sharp food-induced price spikes that the mainland has experienced in the past few months, Kwok indicated that there are clouds on the horizon as the city's food price CPI typically lags that of the mainland's by three to four months.

"It means that it's more a question of when - not if - as to whether food inflation will pick up further," she added.

Mo Pak-hung, an associate professor of economics at Hong Kong Baptist University, also predicted mounting inflation pressure in the city.

"It will become even harder to expect moderate-priced foods from the mainland in the future," said Mo. "Counting on the revaluation of the yuan - say 3 percent to 5 percent a year - food imported to the city from the mainland is likely to continue to hike at a two-digit pace in the coming years."

Another troubling factor arising from "imported inflation" is the fact that when overseas firms increase their prices, it is not just that importers have to pay more for goods. It also increases net inflation in their own market.

One example of this is the rally in global food prices over the past few years. World wheat and maize prices have risen 57 percent, rice 45 percent and sugar 55 percent over the past six months and soybeans are at their highest price in 16 months, according to a UN report.

Global commodities prices have also rallied to two-year highs, partially due to the effects of the weak US dollar. Silver, soybeans and copper jumped to levels last seen in October 2008 as investors moved money into hard assets in anticipation that the massive economic stimulus plan announced by the Federal Reserve will continue to weaken the dollar, according to an earlier Associated Press report.

Hang Seng's Fan said that since salaries generally could not catch up with the spike in prices, the majority of people living in Hong Kong are likely to see a big increase in the cost of living.

"In Hong Kong, where the economy is slowing down and inflation pressure is adding up, life for the low-income group will definitely become even more difficult," Fan added.

China Daily

(HK Edition 11/27/2010 page3)