HKEx gives green light to extend trading hours from March 2011

Updated: 2010-11-23 07:22

By Oswald Chen(HK Edition)

|

|||||||

Move will align stock exchange with regional bourses

Hong Kong Exchanges & Clearing Ltd (HKEx), operator of Asia's third-biggest stock market, has given its approval to extend trading hours beginning March 7, 2011.

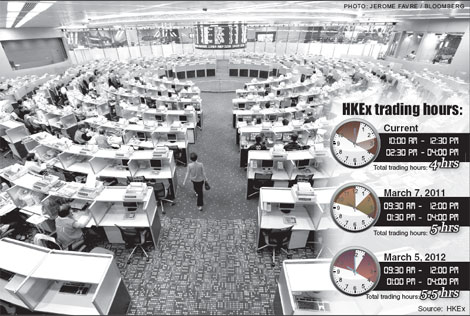

The city's stock market will trade from 9:30 am till noon, while the afternoon session will run from 1:30 pm till 4 pm. That compares with the current 10 am to 12:30 pm and 2:30 pm to 4 pm sessions. The daily trading hours will thus be extended from four to five hours.

Trading hours will be further extended from March 5, 2012, with the lunch break being cut to one hour from 1.5 hours on that date. From that date, the local bourse will reopen after the lunch break at 1 pm, meaning the daily trading hours will be extended to 5.5 hours.

HKEx Chairman Ronald Arculli said that the local stock exchange market needs to realign its trading hours with other established financial centers in the region - including the mainland and Singapore - if the city wants to preserve its status as an international financial center.

"After consulting with the frontline stock brokers, we think we should respect their opinions regarding the lunch hours. Therefore we will consult the stock broker firms again regarding the total abolition of the lunch hour," Arculli said.

Hani Securities (HK) Limited Director K.L.Yu said that local brokerage firms should be agreeable to the changes as it will enhance turnover on the bourse in the long run.

"The extension of trading hours might not enhance turnover on the local bourse in short run," Yu said. "However, if the stock exchange witnesses a bull market, the extension of trading hours could significantly enhance market turnover. And even if the stock exchange is heading towards a bear market, volume is still likely to be higher than before."

Yu even envisaged that HKEx would eventually be able to operate as a 24-hour non-stop trading center. He said that it could be done if the bourse was able to develop more sophisticated Internet stock-trading platforms and brokerages increase their shift rosters to cope with the extra hours.

Bloomberg contributed to this story.

China Daily

(HK Edition 11/23/2010 page2)