Link REIT's payouts up 11.1% to HK$1.17b

Updated: 2010-11-11 06:57

By Oswald Chen(HK Edition)

|

|||||||||

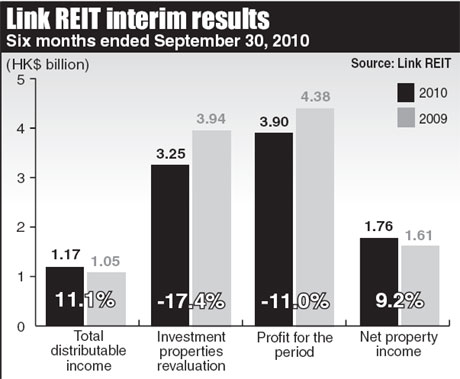

Community shopping mall operator the Link Real Estate Investment Trust (Link REIT) reported Wednesday that its total distributable income (TDI) registered an 11.1 percent jump to HK$1.17 billion for the six months ended September 30, compared with the previous year.

The distribution per unit (DPU) was HK$0.53, an increase of 9.3 percent year-on-year.

The Link Management, the manager of the Link REIT, attributed the increase in its DPU to the continued growth in average rent levels, strong rental reversion and stable occupancy rates.

The Link REIT's net property income also jumped 9.2 percent to HK$1.76 billion from HK$1.61 billion in the previous fiscal year.

However, the Link REIT experienced a 17.4 percent decline in investment properties' revaluation to HK$3.25 billion, bringing down its net profit for the period to HK$3.90 - an 11 percent drop.

Looking forward, George Hongchoy, executive director and chief executive officer of the Link Management, said that the firm will rely on its asset enhancement initiatives (AEIs) - redeveloping properties - and possible property acquisitions with return rates of at least 15 percent to fuel future growth. He said two AEIs are to be completed in the next two years and they have another four in the pipeline pending government approval.

Hongchoy reiterated that the Link REIT possesses sufficient financial resources to undertake any business acquisitions if necessary.

"Our current gearing ratio is 17.1 percent so that even if we undertake, let's say a HK$10 billion business acquisition," Hongchoy said, "our gearing ratio is still under 45 percent. This suggests that our room for business acquisition."

Financial analysts said that the Link REIT's investment potential lies in its asset value upgrade potential rather than its dividend yield, which has declined to nearly 4.2 percent with the share prices rising 27.01 percent this year since January.

"With the Link REIT relying on AEIs and potential property acquisitions to enhance its asset value, we are optimistic on Link REIT," said Kenny Tang, head of research and executive director at Redford Asset Management.

China Daily

(HK Edition 11/11/2010 page3)