Soft commodity prices to climb further

Updated: 2010-11-05 08:20

By Joy Li(HK Edition)

|

|||||||

Higher oil prices, weaker US dollar aiding the boom

Agricultural commodities will see a further rally in prices over the coming weeks, with corn and soybean seeing the most support, according to a report released by Dutch bank Rabobank in Hong Kong Thursday.

Cotton, sugar, coffee, grains, oilseed and live cattle futures all recorded strong gains this year, with prices moving to fresh highs during the latest phase of the soft commodity boom.

Brady Sidwell, assistant director of food & agribusiness at Rabobank, thinks that the boom this year is quite different from the last one in 2008 during the global financial crisis.

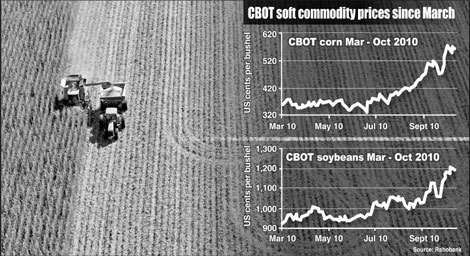

Higher oil prices, a weakening US dollar and reduced stock have worked together to send soft commodity prices soaring. According to data compiled by the Chicago Board of Trade (CBOT), corn prices went up from 360 US cents per bushel in March to 560 US cents per bushel in October. During the same period, wheat prices rose from 470 US cents per bushel to 670 US cents per bushel; while soybeans climbed from 925 US cents per bushel to 1,200 US cents per bushel.

In its latest outlook report, Rabobank reiterated its bullish view on corn and soybeans in the coming three months. Given the likelihood of further US yield down-grade by the US Department of Agriculture and uncertainty about the mainland's imports, the Rabobank Quarterly CBOT corn forecast predicted that corn prices will peak in the first half of 2011 at 580 US cents per bushel and then scale back to 500 US cents per bushel in the third quarter of 2011.

Despite a record US harvest, soybean prices have also rallied to new contract highs. Even at their current elevated price levels, the bank sees no relief from the demand-driven rally currently in play and believes there is further upside potential for soybean prices. The Rabobank Quarterly CBOT soybean forecast predicted that soybean prices will peak in the first half of 2011 at 1,275 US cents per bushel and then fall back to 1,150 US cents per bushel in the third quarter of 2011.

The uncertainty of the La Nina weather pattern and its impact on South American supply is ongoing and should be factored in, the report adds. The UN weather agency said in mid October that the La Nina climate phenomenon is likely to increase from moderate to strong over the next four to six months, pulling down crop production as a result of a drier climate.

The Buenos Aires Cereals Exchange in Argentina issued a report in late October, saying that farmers are accelerating soy and corn planting ahead of reduced rainfall by La Nina. The exchange said about 4.6 percent of the 2010-11 soybean crop, covering 18.7 million hectares, has been planted to date, in sharp contrast with the 0.2 percent of the forecast area sown a year earlier.

China Daily

(HK Edition 11/05/2010 page3)