ING: City's investor sentiment continues to rise

Updated: 2010-10-20 06:58

By Li Tao(HK Edition)

|

|||||||

Hong Kong investors are among the most sanguine in Asia, a survey shows.

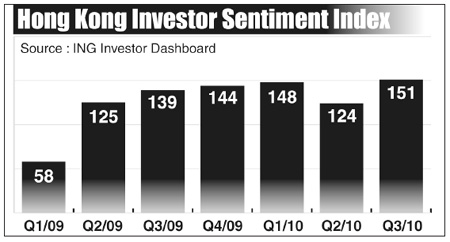

According to the ING Investor Dashboard Survey index, which tracks investor sentiment across Asia, Hong Kong rose to 151 in the third quarter of 2010, up from the previous quarter's 124 - the biggest increase in the region. It is also the highest level that Hong Kong has attained since a financial crisis low of 58 in the first quarter of 2009.

A reading above 120 on the index indicates that respondents are optimistic about economic growth while a reading below 80 indicates pessimism. It is also the first time since the second quarter of 2008 that the Hong Kong index outstripped the mainland, which rose from last quarter's 127 to 143.

India had the highest index level in the region at 175, followed by the Philippines at 157 and Thailand at 154. Hong Kong came in fourth.

"Investors in Hong Kong and on the mainland are definitely more confident now compared with last quarter - when they were less sure how much the tightening measures imposed by the Central Government would affect the Greater China economies," said Michael Chiu, senior investment manager at ING Investment Management Asia/Pacific.

"Now that the measures are taking effect, concerns of over-tightening are beginning to ease and investors are becoming more confident about the economy," Chiu told reporters during a media briefing Tuesday.

The outlook on the city's stock and property markets for the fourth quarter also strengthened. Over 60 percent of respondents are bullish about home prices in the next quarter, as well as the stock market. According to Chiu, the local bourse has reaped benefits from city's fast economic growth, including the establishment of an offshore renminbi trading center and the uptake in the IPO market.

The Hong Kong government in August raised its full-year GDP growth forecast for 2010 to between 5 and 6 percent from the 4 to 5 percent range, supported by the city's strong exports to the mainland and other Asian markets.

And despite remaining cautious about an economic recovery in the US, Hong Kong and mainland investors appear confident that a double-dip recession is unlikely as their economies "decouple" from the global market, with more respondents indicating that the European debt crisis is not affecting their investments, according to the survey.

Chiu expects more quantitative easing measures to be introduced in the US and other developed markets, leading to continued low interest rates and a weak dollar to help their economies.

"Instead of implementing a one-off increase in the exchange rate, we expect the Central Government to appreciate the yuan gradually for a prolonged period at a rate of 3 to 5 percent a year for the next five to 10 years," Chiu added.

Almost 90 percent of Hong Kong respondents and 61 percent of mainland investors in the survey agree that the yuan will continue to appreciate against the US dollar.

China Daily

(HK Edition 10/20/2010 page2)