Li & Fung: EU debt crisis may hurt early 2011 profits

Updated: 2010-05-19 07:19

By Oswald Chen(HK Edition)

|

|||||||

|

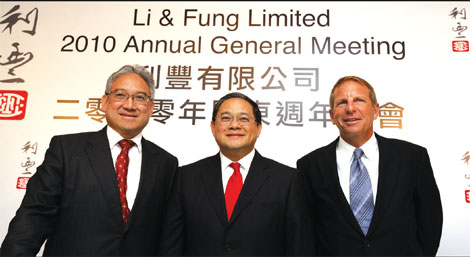

(From left) Li & Fung Ltd Managing Director William Fung, Chairman Victor Fung and President Bruce Rockowitz attend the 2010 annual general meeting in Hong Kong Tuesday. Daniel J. Groshong / Bloomberg |

Hong Kong-based global consumer goods exporter Li & Fung Ltd cautioned that the continuity of the European debt crisis may affect its European clients, and if the crisis persists, its negative effects on the group's profitability may be evident in early 2011. The blue-chip exporter also said it has earmarked $1 billion of funds for future business expansion through acquisitions.

The Group held its annual general meeting Tuesday, during which its senior management answered media enquiries concerning the Group's latest business developments.

Li & Fung managing director William Fung did not comment on whether its European clients will go bankrupt because of the European debt crisis, but predicted that its European clients' operating costs will rise if the euro's value continues to decline.

Moreover, the European economic recovery is not as resilient as it has been in the US. If the euro and the British pound continue to depreciate, it may hurt the purchasing power of the European clients and ultimately negatively impact the Group's profitability, Fung added.

The situation, however, may not be so gloomy as forecast since currency depreciation also has its advantages.

"Provided the European debt crisis does not extend to its financial system, the depreciation of the euro and British pound may enhance the competitiveness of the export sector in the region." Fung said, adding that because 95 percent of the Group's business deals are denominated in US dollars, the European debt crisis should not severely affect the Group's business.

Regarding the US market performance, the Group is much more optimistic.

"The US market is faring much better, as the economic recovery pace in the country is solid. As 75 percent of the Group's revenues is generated in the US, the recovery in the US market will lay a solid foundation for the recovery of the Group's business," Fung emphasized.

Concerning the business acquisition timetable, Fung said that the Group will announce details in the near future, but refused to disclose any specific acquisition target details.

Fung added that the Group's future acquisitions will focus on three major business segments.

"First, we will target beauty and cosmetics brands, since these are new businesses of the Group. We will make use of acquisitions to leverage our capability in this business sector.

"Second, we will try to buy some companies that are specializing in US import and wholesale businesses. We hope that these acquisitions can contribute $3 billion revenues to the Group by the end of 2010.

"We are also interested in European counterpart companies, and estimate that this business segment can bring $1 billion revenues to the Group by the end of 2010."

China Daily

(HK Edition 05/19/2010 page3)