GCL-Poly Energy aiming to double output in 2010

Updated: 2010-04-30 07:37

By Li Tao(HK Edition)

|

|||||||||

|

Technicians keep watch on the monitors in a GCL Solar Energy Technology Holdings Inc control room. GCL-Poly Energy Holdings Ltd, a Hong Kong-listed power producer, expects to double its polysilicon output this year. Provided to China Daily |

Expects demand to drive hikes in polysilicon production

GCL-Poly Energy Holdings Ltd, China's biggest producer of polysilicon - the key material for solar cell production, has told Hong Kong investors it expects to double its polysilicon output this year, in anticipation of strong demand for its products.

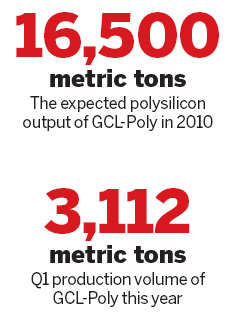

Output will likely increase to 16,500 metric tons this year from around 7,454 metric tons last year, the company said in a trading update on Thursday.

Production volume in the first quarter of this year totaled 3,112 metric tons, up 185 percent over the same period in 2009, it said.

GCL-Poly Energy said because of technological upgrades, it has cut production costs per kilogram of polysilicon to $34, yielding a gross profit margin of about 30 percent.

The company expects to further reduce the production cost to about $30 per kilogram by the end of the year, it said.

Meanwhile, it forecasts that global demand for polysilicon will remain strong in the second quarter of 2010, while selling prices will remain at stable levels.

The company said it has completed the acquisition of about 70 percent of the equity interest in Konca Solar Cell Co, Which produces polysilicon wafers.

The company plans to expand the wafer capacity at Konca Solar as well as at the wafer plants in Xuzhou and Changzhou, it reported.

"As the biggest polysilicon producer in China, GCL-Poly's expansion is understandable since demand is substantial. But overcapacity has long been an issue in this industry,a challenge that has haunted most polysilicon makers in China, especially small ones," a Shenzhen-based energy analyst, who requested anonymity, told China Daily.

The analyst said the global annual consumption of polysilicon is only around 600,000 metric tons, while Chinese producers have total production capacity of 900,000 metric tons, resulting in a huge capacity glut.

The production cost of Chinese producers, on the other hand, normally ranges between $40 to $50 per kilogram of polysilicon, a far cry from the commonly incurred $30 per kilogram production cost of many top-notch international manufacturers.

"Chinese polysilicon factories, particularly small ones, have no research team, and only import technology from abroad. It is hard for them to lower their production costs or cut their selling prices. And polysilicon manufacturing, as we all know, can cause substantial environmental pollution to the environment," the analyst said.

The central government, in fact, has been aware of the overcapacity problem. The State Council has identified six key industries that are facing overcapacity problems, with polysilicon manufacturing among the six industries.

China Daily

(HK Edition 04/30/2010 page2)