City investor confidence rises

Updated: 2010-04-15 08:07

By George Ng(HK Edition)

|

|||||||||

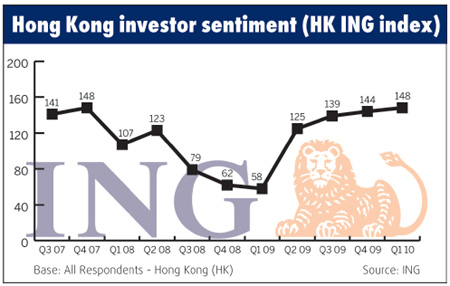

ING survey results show rebound to pre-crisis record-high level

Investor sentiment in the city has rebounded to the pre-crisis level, which is a record high, as investors are increasingly confident about the prospects for the economy, according to a survey by Dutch financial giant ING.

Meanwhile, the strong performance of the property and stock markets since March last year, driven by ample liquidity after governments around the world implemented ultra-easy monetary policies in the wake of the global financial crisis in 2008, has also helped reinforce investors' sentiment, ING said in its latest sentiment report released Wednesday.

The ING Investor Sentiment Index for Hong Kong rose to 148 in the first quarter of this year from 144 in the fourth quarter last year.

The latest reading of optimism is a record high and was last seen in the fourth quarter of 2007. It is also the fourth consecutive quarter of steady increase after hitting a low of 58 in the first quarter last year.

"Hong Kong investors continue to show strong confidence in the local economy, partly due to better-than-expected corporate earnings and the robust property market that's resulted from tight supply," said Oscar Leung, a senior investment manager.

"More than 50 percent of publicly-listed companies in Hong Kong have reported better-than-expected results, creating generally positive sentiment in the market, so it is understandable that more Hong Kong investors are willing to increase their stake in local stocks," he said.

"A stable and steadily growing local economy with greater job security - the unemployment rate for December 2009 to February 2010 declined to 4.6 percent - also fuels this optimism," the investment manager added.

Hong Kong investors continue to have a more positive outlook on the local economic situation in the next quarter and appear to be more bullish about the US economy in the second quarter of 2010.

Currently, 71 percent of Hong Kong investors believe the economic situation will improve in the next quarter, signaling continued confidence in the local economies.

Hong Kong investors are more positive about the stock and property markets in the second quarter, the survey also revealed.

Inflation and potential interest rate hikes remain key concerns of Hong Kong investors, with 70 percent of investors looking to boost or adjust their investment positions to hedge against the risk of rising inflation, ING notes.

Nonetheless, investors' risk appetite remains modest despite a more bullish outlook for the local economy.

Investors appear to be adhering to a more conservative and balanced strategy focused on capital preservation. Currently, 80 percent of investors are invested in local stocks, while 79 percent are holding on to cash deposits and 56 percent are invested in foreign currency.

Looking ahead to the second quarter, 49 percent of existing investors plan to increase their investments in stocks, 35 percent in foreign currencies, 33 percent in overseas mutual funds and unit trusts, and 31 percent in both gold and overseas stocks, indicating strong confidence in the global recovery as well.

China Daily

(HK Edition 04/15/2010 page2)