New Year's spending boosts inflation

Updated: 2010-03-23 07:35

By George Ng(HK Edition)

|

|||||||||

Annualized rate rises to 2.8% as Feb timing of festival increased prices

The city saw increased inflationary pressure last month as indicated by the acceleration in both nominal and underlying consumer prices.

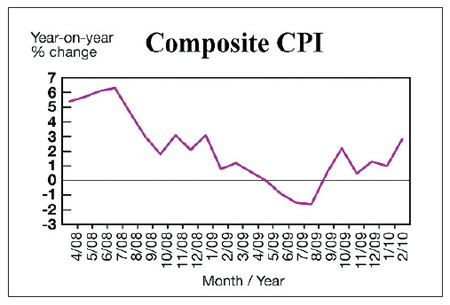

Overall consumer prices as indicated by the Composite CPI rose by 2.8 percent in February over the same month a year earlier, larger than the 1.0 percent rise in January, the Census & Statistics Department said yesterday.

Meanwhile, the underlying inflation rate, which netted out the effects of all one-off relief measures implemented by the government, also posted a year-on-year increase of 1.6 percent in the same month, larger than the virtually nil growth in January.

The larger increase was mainly attributable to the difference in the timing of the Lunar New Year, which occurred in February this year but in January last year, resulting in a surge in the charges for package tours, the prices of fresh vegetables, the costs for meals bought away from home and the prices of poultry in February 2010, the government said.

Taking the first two months of 2010 together to neutralize the effect of the Lunar New Year, the Composite CPI rose by 1.9 percent over a year earlier. Netting out the effects of all one-off relief measures taken by the government, the Composite CPI rose by 0.8 percent in the first two months of 2010 over a year earlier.

"It's more meaningful to look at the inflation rate in the first two months of 2010 combined due to the distortion caused by the timing of the Lunar New Year," a government spokesman said. "Overall price pressures have inched up, but were still tame in early 2010."

Looking ahead, import prices in overall terms are likely to stay soft in the near term in face of the excess capacity in the global economy, the spokesman said.

Locally, the expansion in production capacity brought about by productivity growth and rising investment in recent quarters should also help alleviate the pressure on local business costs, he said. "Overall, the inflation rate, while likely to climb up further as the economic revival takes hold, is likely to remain relatively modest in the near term," the spokesman predicted.

However, some economists warn of potential acceleration in inflation pressure in the medium- to long-term as prices of imported goods rise along with the recovery in the global economy.

"The inflationary pressure on the mainland could feed through to the local economy, as mainland-made products accounted for nearly 30 percent of the local CPI," said Daniel Chan, a senior investment strategist at DBS Bank.

Meanwhile, "the inflationary pressure worldwide could also inch up as the global economy recovers further," he said. For the near term, Chan expects the rise in consumer prices to remain mild.

(HK Edition 03/23/2010 page2)