No privatization in future: PCCW

Updated: 2010-03-10 07:41

By George Ng(HK Edition)

|

|||||||||

PCCW insisted it has no intention to table a new privatization offer as it reported substantial growth in its net profit for 2009.

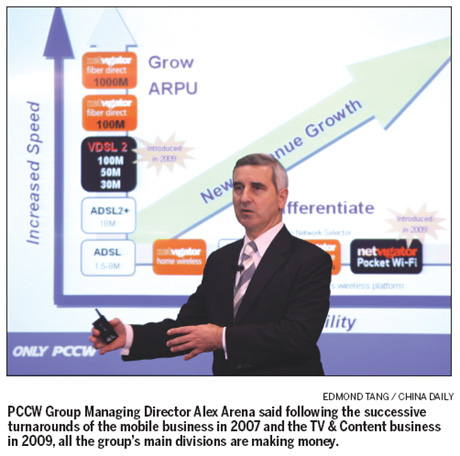

No one in the board has ever talked about a new privatization plan after a $2.1 billion buyout attempt by Chairman Richard Li failed last year, said Managing Director Alex Arena. "I think the privatization is dead," he said.

The city's biggest telecommunications operator posted a net profit of HK$1.61 billion for 2009, up 18 percent from HK$1.27 billion in the previous year.

The company attributed the strong growth in net profit to cost cuts that helped offset the decline in revenue from its core operations, including telecommunications and media.

"Against a backdrop of economic downturn, intense market competition and adverse regulatory decisions, our businesses recorded a satisfactory performance in 2009," Arena said.

Revenue from core businesses declined by 5.2 percent from the previous year to HK$2.67 billion due to fiercer competition among telecom operators as well as because of the adverse impact of a regulatory change.

The Office of Telecommunications Authority exempted all mobile operators from paying interconnection charges to PCCW for connecting calls from their users to fixed lines operated by PCCW from April 2009

However, the company managed to increase its core profit by 24 percent year-on-year to about HK$1.22 billion, due to effective cost saving initiatives that included in staff costs.

Meanwhile, revenue from its property business dropped 58 percent year-on-year to HK$4.22 billion, reflecting lower property sales.

The company declared a final dividend of 13.3 HK cents per share after skipping an interim dividend.

Arena declined to comment whether PCCW can maintain a 60 percent dividend yield in the coming years.

But he said "we will continue to pay a good dividend to our shareholders", noting that the 60 percent yield is at the low end of the historical range.

Looking ahead, the company intends to make further investments to boost its competitiveness and expand its business.

"We continue to invest in new technology, our networks and our services," Arena said.

He also said the company will definitely apply for a free TV license when the government is ready to award it.

(HK Edition 03/10/2010 page2)