BOCHK reports 36% earnings growth

Updated: 2010-02-04 07:37

By George Ng(HK Edition)

|

|||||||

Nine-month gains reflect 99.6% drop in impairment charges

HONG KONG: Bank of China (Hong Kong) Ltd (BOCHK) has announced that its net profit for the nine months ended September 2009 rose 36 percent year-on-year to HK$9.5 billion.

The lender, mainland banking giant Bank of China's (BOC) local operating unit, yesterday announced its quarterly earnings as it unveiled a plan to raise funds by issuing 10-year dollar bonds.

"The quarterly earnings were in line with our expectation," said Paul Lee, a banking analyst at Taifook Securities Ltd.

However, he noted that the improvement was mainly attributable to a sharp drop in the lender's impairment charges against its loan portfolio and investment.

"Earnings from its core operation - the net interest income - actually declined from the same period in the previous year," the analyst noted.

|

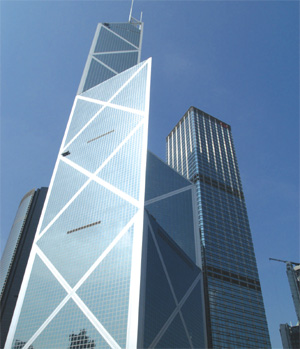

The Bank of China building stands in the Central business district in Hong Kong. Bloomberg News |

During the period, BOCHK's net impairment charges dropped 99.6 percent to only HK$21 million from HK$5.87 billion as the business environment improved and financial markets rebounded sharply from the slump in the second half of 2008.

Net interest income for the period fell 11 percent year-on-year to HK$12.38 billion.

Bonnie Lai, a banking analyst at CCB International Securities Ltd, has kept her full-year 2009 earnings estimate for the lender at HK$13 billion after the bank reported what she described as "in-line" nine-month earnings.

That means BOCHK is going to report a nearly 290 percent surge in its 2009 net profit over the HK$3.43 billion in 2008 when it releases its full year results in April.

Echoing Lee's analysis, Lai said the expected big jump in BOCHK's full-year net earnings is mainly due to the fact that the bank recorded huge impairment charges in the fourth quarter of 2008, while it has no need to do so in the fourth quarter of 2009.

In the same statement, BOCHK unveiled a plan to sell US-dollar denominated subordinated notes to professional investors to "broaden its investor base and diversify funding channels."

The 10-year fixed-rate notes will mature in 2020. The interest rate will be determined later.

The lender did not reveal the amount of the notes issue. But it said funds raised from the notes issue will be used to repay in part or in full the US$2.5 billion subordinated credit facility provided by its parent, BOC.

BOC provided the facility to BOCHK in December 2008 to help strengthen the unit's capital base after it posted a 78 percent decline in net profit over that year due to the negative impact of the financial tsunami.

How much exactly BOCHK is going to raise via the debt issue will depend on the lender's forecast for its business prospects, Taifook's Lee said.

CCB International's Lai believes the lender currently has no need to raise large amount of funds, as its total capital adequacy ratio (CAR) stands at a relatively high level of 16.2 percent.

The subordinated notes will qualify as Tier-2 capital of BOCHK.

Given the high CAR level, BOCHK has no urgent need to raise its capital base to support its loan portfolio expansion, Lai said.

She said the lender could support its loan portfolio expansion with cheaper funds from customer deposits, given its large branch network.

(HK Edition 02/04/2010 page4)