SFC to consult on paperless trading

Updated: 2009-12-31 07:57

By Cheng Waiman(HK Edition)

|

|||||||

HONG KONG: Hong Kong's financial regulators have launched a three-month consultation on the move towards paperless (scripless) securities trading, which will be on a voluntary basis initially, the authorities stressing that there will be further consultation before the move is made compulsory.

The Securities and Futures Commission (SFC), Hong Kong Exchanges and Clearing Limited (HKEx) and the Federation of Share Registrars Limited (FSR) jointly issued a consultation paper yesterday, on a proposed operational model to introduce a paperless securities market in Hong Kong.

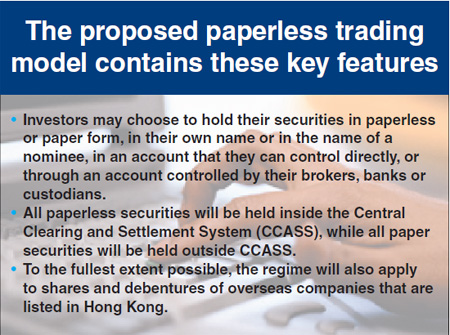

The proposed model will allow investors to hold and transfer securities electronically, in their own names. The regulators said it will be implemented gradually, allowing investors to switch from physical certificates to paperless securities at their own pace. Issuers of initial public offerings will also be able to offer a paperless option.

The regulators said when the market is ready some years later, the public will be consulted again to make the regime compulsory.

"The new model will set the foundation for how scripless securities are implemented in Hong Kong," said SFC Chief Executive Officer Martin Wheatley. "This will strengthen our market infrastructure and facilitate the long-term development of Hong Kong's financial markets."

Currently, investors can hold and transfer securities electronically but not in their own names, as the securities must instead be held in the name of HKSCC Nominees Ltd.

A working group, led by the SFC with representatives from the SFC, HKEx and the FSR, was set up early this year to develop an operational model for paperless trading in Hong Kong.

The joint working group believes that by enabling investors to hold securities in their own names, shareholder transparency can be enhanced while investors will be able to enjoy the full benefits of ownership.

The group also said the move will enhance market efficiency while promoting environmental protection.

According to the 52-page consultation paper, the elimination of the use of physical certificates is in line with the global trend, and has been an internationally recognized objective for the last twenty years.

A number of leading markets around the world have already implemented a scripless securities market, i.e., "dematerialization", including the UK, Australia and the Chinese mainland. The consultation paper said it would be in Hong Kong's interest to keep in line with this trend. Moreover, adopting dematerialization could also provide greater opportunity for future linkages with other scripless markets.

The consultation period will last for three months until March 31, 2010.

(HK Edition 12/31/2009 page6)