Home prices dip 1.3% in November

Updated: 2009-12-05 06:51

By George Ng(HK Edition)

|

|||||||

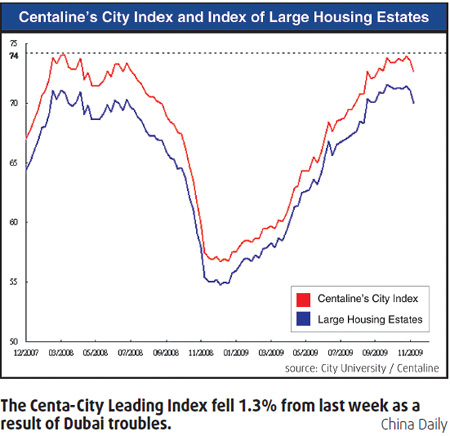

HONG KONG: Home prices in the city fell 1.3 percent in the week ended November 29 to the lowest in ten weeks, as worries about "cascading effects" of the Dubai crisis kept some buyers at bay.

But analysts remain positive about the prospect for the property market.

The Centa-City Leading Index, a key gauge for residential property prices in the city, dipped to 72.61 in the week from 73.56 the previous week, Centaline Property Agency Ltd, the compiler of the index, said in a report yesterday.

The weekly percentage drop is the biggest in a year, the company noted.

"Property prices fell in response to news about the Dubai debt crisis, as did the equity market," Wong Leung-sing, associate director (Research Department) of Centaline, told China Daily.

"However, prices have since stabilized, while transaction volume remained stable over the last week," he said.

The analyst remains bullish about the prospect for the housing market, citing strong demand.

"Whenever asking prices soften to relatively reasonable levels, buyers are quick to pick up the supply," he said.

He sees a moderate uptrend for home prices in the months to come.

The optimism is shared by Patrick Chow, head of research at Ricacorp Properties Ltd, another large property consultant firm.

"Prices will definitely resume their uptrend as everybody is bullish about the prospects for the housing market," he said, citing strong demand against historically low supply.

The continuous influx of hot money from the US and Europe following the global financial crisis has sent local asset prices soaring, with home prices surging 28 percent so far this year.

With the Dubai debt crisis happening, oil money from the Middle East will also pour into Asia as economic outlook for the region looks more promising, Chow said.

Meanwhile, local residents will find homes more affordable now as mortgage rates remain at historically low levels while many employees are expecting a pay hike next year, he said.

All these factors suggest stronger demand for properties, while supply is expected to remain tight in the future, boding well for the prices.

It is estimated that aggregate new home supply for the entire next three-year period will be only around 30,000 units, compared with an average of 30,000 a year in recent years, Chow said.

The new-home supply from private developers in the first nine months of this year totaled 5,500 units, the Transport and Housing Bureau said in October.

For the whole of 2008, developers built only 8,800 new homes, the fewest since records were first kept, in 1997.

(HK Edition 12/05/2009 page5)