Wine, a profitable liquid investment

Updated: 2009-10-28 07:48

By George Ng(HK Edition)

|

|||||||

HONG KONG: Hong Kong has become the toast of the global fine wine business recently, thanks to increasingly robust investment demand in addition to stronger consumer appetite for fine wine after the removal of wine duties early last year.

Auctioneer Sotheby's said recently it has sold $14.3 million of wine so far this year in Hong Kong, far outstripping its auction sales of $10.5 million in New York and $8 million in London.

But why should anybody choose wine in an investment world that boasts a galaxy of choices such as stocks, forex, bonds, options and warrants, which are all handier and in some sense more "liquid"?

The potential for value increase is always a key factor to consider in making any investment, and wine in the cellar is no exception.

Statistics indicate that price appreciation of fine wine averaged over 15 percent per annum in the past decade.

Be reminded that this price rise was mainly driven by demand from developed markets. The level of appreciation can only accelerate in the future as increasing prosperity and lifestyle changes in emerging economies, particularly in Asia, will assuredly boost the demand for fine wine.

China, the world's most populated country, is increasingly becoming a "big market" and India, the second most populated nation, will soon be another one, Jo Purcell, Managing Director of fine wine merchant Farr Vintners, told China Daily.

"Last year, our company generated about 70 percent of its sales from Europe and 30 percent from the Asian market. This year, we expect a 50-50 ratio," she said.

In fact, according to a study commissioned by the Hong Kong Trade Development Council, the value of total wine consumption in Asia, excluding Japan, is expected to double to $17 billion by 2012 and to increase further to $27 billion by 2017.

The long-term uptrend in the value of fine wine draws its fundamental support from consistently limited supply against growing global demand.

The geographical area worldwide that is suitable for producing the right grapes for fine-wine brewing is finite. Then there are the vagaries of weather that can affect vintages. All these naturally cap fine wine production.

Furthermore, the quantity of any wine produced from any given vintage can only decrease over time as consumption increases with maturity.

The lower risk of fine-wine investment, best expressed in terms of price volatility, is another appealing factor for many less adventurous investors.

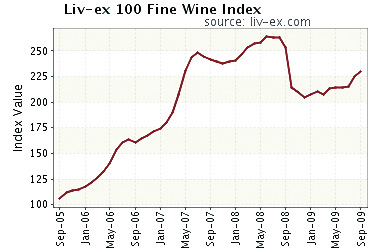

The Sharpe ratio - a popular measure of reward per unit of risk - for fine wine as represented by the Liv-ex.com 100 wine index was around 1.2 in the period between March 2004 and April 2009, much higher than the 0.7 and 0.2 of gold and oil, respectively, according to calculations by The Wine Investment Fund, a pioneer fine wine investment fund.

The Liv-ex 100 Index, compiled by leading fine wine exchange, London International Vintners Exchange (Liv-ex), is the traditional benchmark for fine wine market returns.

Prices of fine wine have been demonstrating strong resilience even during periods of economic downturns or recessions. For example, after the financial crisis in 2008, prices of fine wine as measured by the Liv-ex 100 Index fell less than 15 percent while equity markets around the world plunged as much as 70 percent.

The roller coaster run of financial markets, particularly during financial crises, has also highlighted the need for investors to diversify their investment portfolio.

Given the stable long-term uptrend in its price, fine wine has proven to be a good alternative investment.

Having identified the favorable factors for investment in fine wine, next comes the question of in which wine to invest.

Experts believe Bordeaux wine is a safe play for entry-level investors.

"It is one of the easiest to understand," said Farr Vintners' Purcell.

Many experts believe Hong Kong has become a key wine trading hub worldwide, superceding London and New York, after the government removed wine duties early last year.

(HK Edition 10/28/2009 page4)