|

Fed's Bernanke to play the hawk on Capitol Hill

(Reuters)

Updated: 2006-02-15 13:50

Federal Reserve Chairman Ben Bernanke will seek to establish his

anti-inflation credentials when he delivers the central bank's semi-annual

report to Congress on Wednesday after just two weeks on the job.

The Fed chairman's testimony, always closely watched, will be parsed more

intently than usual as financial markets try to size up the man who took over

from Alan Greenspan on February 1 and search for clues on the path of interest

rates.

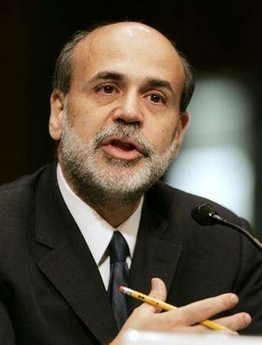

Ben Bernanke faces

the U.S. Senate Banking Committee on Capitol Hill in Washington in this

November 15, 2005 file photo. Bernanke will seek to establish his

anti-inflation credentials when he delivers the central bank's semi-annual

report to Congress on February 15, 2006.

[Reuters] | Bernanke, a top economic adviser to

President George W. Bush until he took the Fed's reins, appears before the House

of Representatives' Financial Services Committee at 10 a.m. He goes before the

Senate Banking Committee on Thursday.

After he delivers the Fed's twice-yearly monetary policy report, Bernanke

will be asked questions by lawmakers eager to draw him into wider policy

debates, something he has said he will be reluctant to participate in.

The former chairman of the Princeton University economics department is

already a known quantity on Wall Street, having served on the Fed's board for

nearly three years before moving to the White House last June.

Bernanke's first Fed stint came as the central bank was trying to energize a

sluggish economy and thwart the risk of deflation, a potentially crippling

economy-wide fall in prices.

He was then an outspoken advocate of tough steps to lift the inflation rate,

a fact that has led some in financial markets to question whether he can be

tough on prices.

But now the economy appears to be firing on all cylinders and a more

traditional enemy -- inflation -- is back on Wall Street's radar screen.

"His challenge for the early part of the chairmanship is to establish his

anti-inflation credibility as well as he established his anti-deflation

credibility," analysts at consulting group ISI Group wrote earlier this week.

TOUGH TONE, FEW DETAILS

Although Bernanke is expected to talk tough on inflation, economists said he

will offer few details on how aggressively the Fed may need to act to keep it at

bay.

After raising benchmark overnight interest rates by a quarter-percentage

point to 4.5 percent on January 31, the central bank said "some further policy

firming may be needed." The new Fed chief is expected to stick close to that

guidance.

Included in the report he is to deliver will be forecasts for economic

growth, inflation and unemployment from members of the central bank's

policy-making Federal Open Market Committee, which could offer some clues on

where they see rates headed.

The central bank's favorite measure of core inflation rose 1.9 percent last

year, at the top end of its perceived comfort zone. Analysts caution it could

move higher still.

"I think the most important thing is for him to keep inflation expectations

anchored," said Doug Lee, president of Economics From Washington. "It's hard for

them to stop raising rates if inflation is edging up."

A month ago, financial markets thought there was only about a 50-50 chance of

a rate hike at the Fed's upcoming meeting on March 27-28. But after a slew of

upbeat data, including a surprise drop in the U.S. jobless rate to an

historically low 4.7 percent, a March rate hike is seen as a done deal.

Financial markets now see a near-certainty of another quarter point move by

mid-year as well and traders will examine Bernanke's every word as they consider

changing their bets.

|