India's growth could outdo China's

Updated: 2015-04-02 11:06

By Paul Welitzkin in New York (China Daily USA)

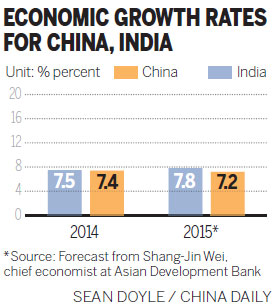

Comments Print Mail Large Medium SmallThe chief economist for the Asian Development Bank expects economic growth in India to outpace China this year and lists the economic crisis in Greece as one of the risks that could upset the region's economy in 2015.

Speaking at a forum sponsored by the Jerome A. Chazen Institute of International Business held at Columbia University in New York on Wednesday, Shang-Jin Wei said a reduction in commodity prices, the continuing economic recovery and reforms will influence Asian economies this year.

"Most Asian countries are importers of commodities so lower prices will benefit their economies," he said.

|

From left: Wei Jiang, director of the Jerome A. Chazen Institute of International Business at the Columbia University; Jerome Chazen, founder and chairman of Chazen Capital Partners; and Shang-Jin Wei, chief economist for the Asian Development Bank, at a forum at the university in New York on Wednesday. Wei discussed his economic outlook for Asia this year at the forum. Provided to China Daily |

Noting that India - Asia's second-largest economy after China - elected a new government in 2014 led by Prime Minister Shri Narendra Modi, Wei expects Modi's reform platform to lift economic growth to 7.8 percent, ahead of China's expected 7.2 percent.

China's economy will reflect the country's shrinking labor force, rising wages and appreciating currency, Wei said. "The labor force (contraction) is due to demographics and also the result of the one-child policy," he said.

Wei emphasized how economic reforms will drive the region's economies, citing Indonesian President Joke Widodo's strategy of taking advantage of falling oil prices to cap a diesel subsidy and scrap aid for gasoline.

"They had talked about doing this for years but could never get it done politically. Lower oil prices gave them an opportunity and now they will be able to use those funds for other uses," said Wei. He urged other nations to follow that example.

Because of slumping commodity prices, Wei doesn't anticipate inflation to be a major concern in Asia, forecasting a rate of 2.6 percent this year and 3 percent in 2016.

Even with the economic gifts of lower oil prices and a recovering economy in the US and other major developed nations, Wei said there are risk factors for the Asian economy this year. The top one is the economic crisis in Greece. Plagued by enormous debts, Greece agreed to a 2010 bailout that resulted in harsh spending cuts which has led to persistently high unemployment in the country.

The Greece situation combined with the prospect of a continuing Russian recession, could roil global markets including those in Asia, Wei said. Other risk factors include slower-than-expected growth in China and India and capital outflows that could occur depending on how fast and how much the United States raises interest rates.

Wei said Asia must continue to look at expanding financial services, particularly in rural and low-income areas. He noted that in Asia about 27 percent of adults have a bank account, far below the 54 percent in Latin America and the 93 percent in high-income countries like the US.

A key component of any financial development strategy should be a plan to give rural and low-income households access to banking services. "In the sparsely-populated island nations of the Pacific, it can be expensive to open a bank branch. The cost to make a $5,000 loan is about the same as the cost to make a $5 million loan," he said.

To address these inequities, Wei said banks should work with merchants in these areas to establish an office in the shops that could provide bank services.

paulwelitzkin@chinadaiklyusa.com